Business Intelligence software: an objective comparison

Business Intelligence (BI) tools are software solutions designed to help users create, distribute, and analyze reports, dashboards, data analytics, and machine learning models. Their primary purpose is to extract meaningful insights from data quickly and efficiently. Since 2007, we have been conducting in-depth research and evaluations of the best and most widely used BI tools on the market, assessing them based on more than 250 criteria. On this page, we explore the key benefits of BI tools and provide an unbiased overview of leading software solutions. Additionally, we explain why Excel falls short as a BI tool and outline the five essential steps for selecting the right BI solution. Any questions about our research? Feel free to reach out for more information or schedule an appointment with us today.

The 7 benefits of Business Intelligence tools

BI tools allow you to quickly extract insights from large datasets, but their advantages go far beyond that. Here are seven key benefits of using BI tools:

- Gain a clear understanding of corporate and external data and enable big data analytics

- Ensure clear visualization and availability of management information

- Identify bottlenecks to improve workflow and processes

- Equip users with the tools they need to improve business processes

- Leverage data-driven insights to enhance overall business performance

- Get the perfect support for performance management and making strategic decisions

- Utilize intelligent dashboards for clear, real-time reporting and easy data tracking

Overview of BI tools for Data Analysis

Click on any tool name to learn more, or refer to the Business Intelligence & Analytics Guide™ 2025 for an objective, in-depth comparison to help you choose the best BI solution for your organization. The list below is organized alphabetically for easy reference. At Passionned Group, we are 100% independent and have no affiliations with BI tool vendors, ensuring a completely unbiased evaluation.

Click on any tool name to learn more, or refer to the Business Intelligence & Analytics Guide™ 2025 for an objective, in-depth comparison to help you choose the best BI solution for your organization. The list below is organized alphabetically for easy reference. At Passionned Group, we are 100% independent and have no affiliations with BI tool vendors, ensuring a completely unbiased evaluation.

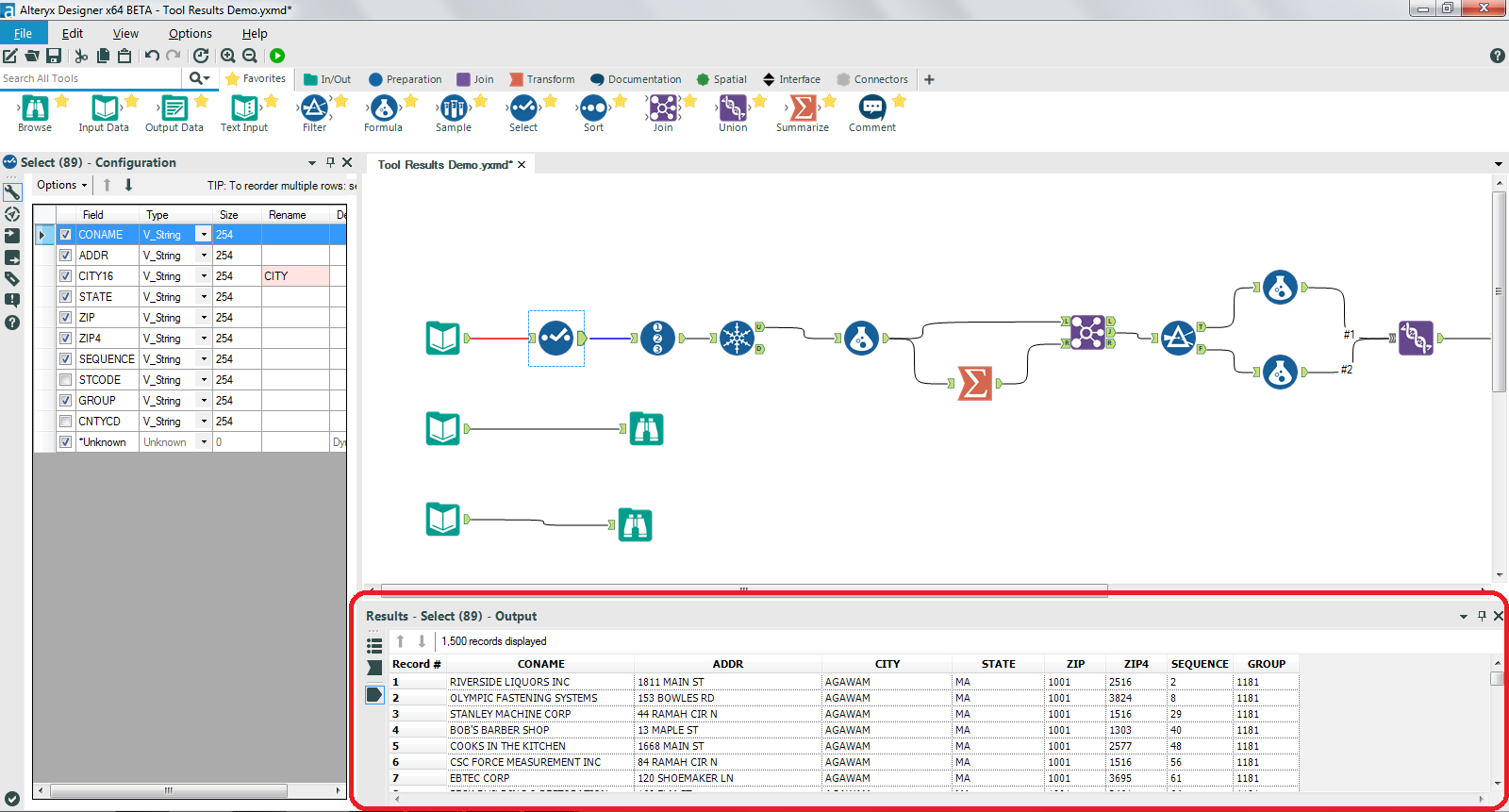

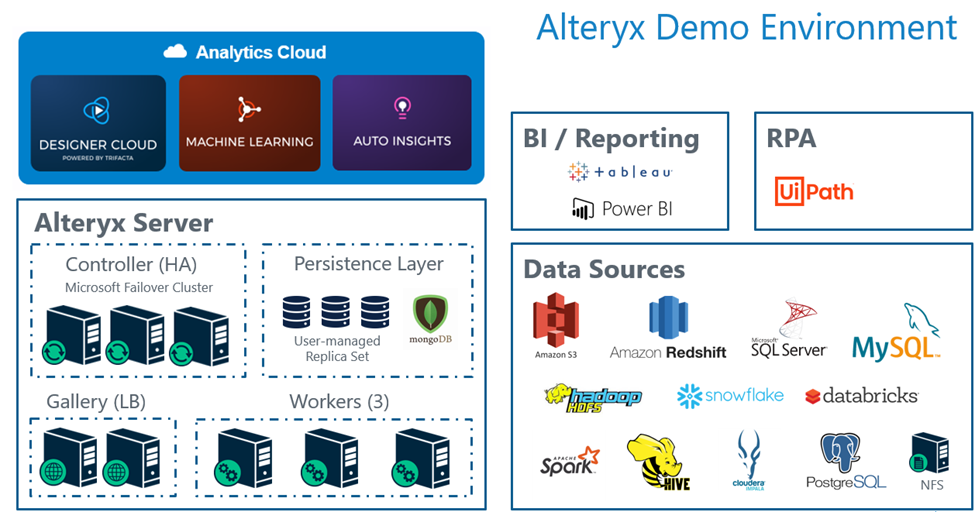

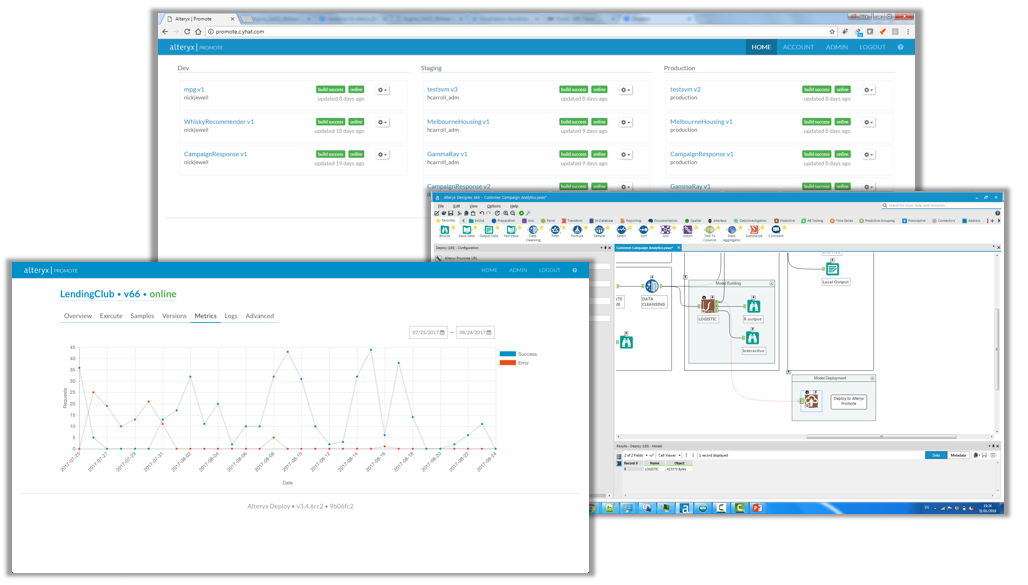

1. Alteryx

Alteryx is widely known for its products Alteryx Designer, Alteryx Server, Alteryx Analytics, Alteryx Connect, and Alteryx Intelligence Suite. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from Alteryx are strong in the following areas, among others:

Alteryx is widely known for its products Alteryx Designer, Alteryx Server, Alteryx Analytics, Alteryx Connect, and Alteryx Intelligence Suite. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from Alteryx are strong in the following areas, among others:

- analytics

- machine learning

- data science

- Python

- text mining

- authentication

- advanced analytics

- Windows

- analysis

- computer vision

Figure 1: Alteryx Designer

Figure 1: Alteryx Designer Figure 2: Alteryx Server

Figure 2: Alteryx Server Figure 3: Alteryx Analytics

Figure 3: Alteryx Analytics2. DataRobot

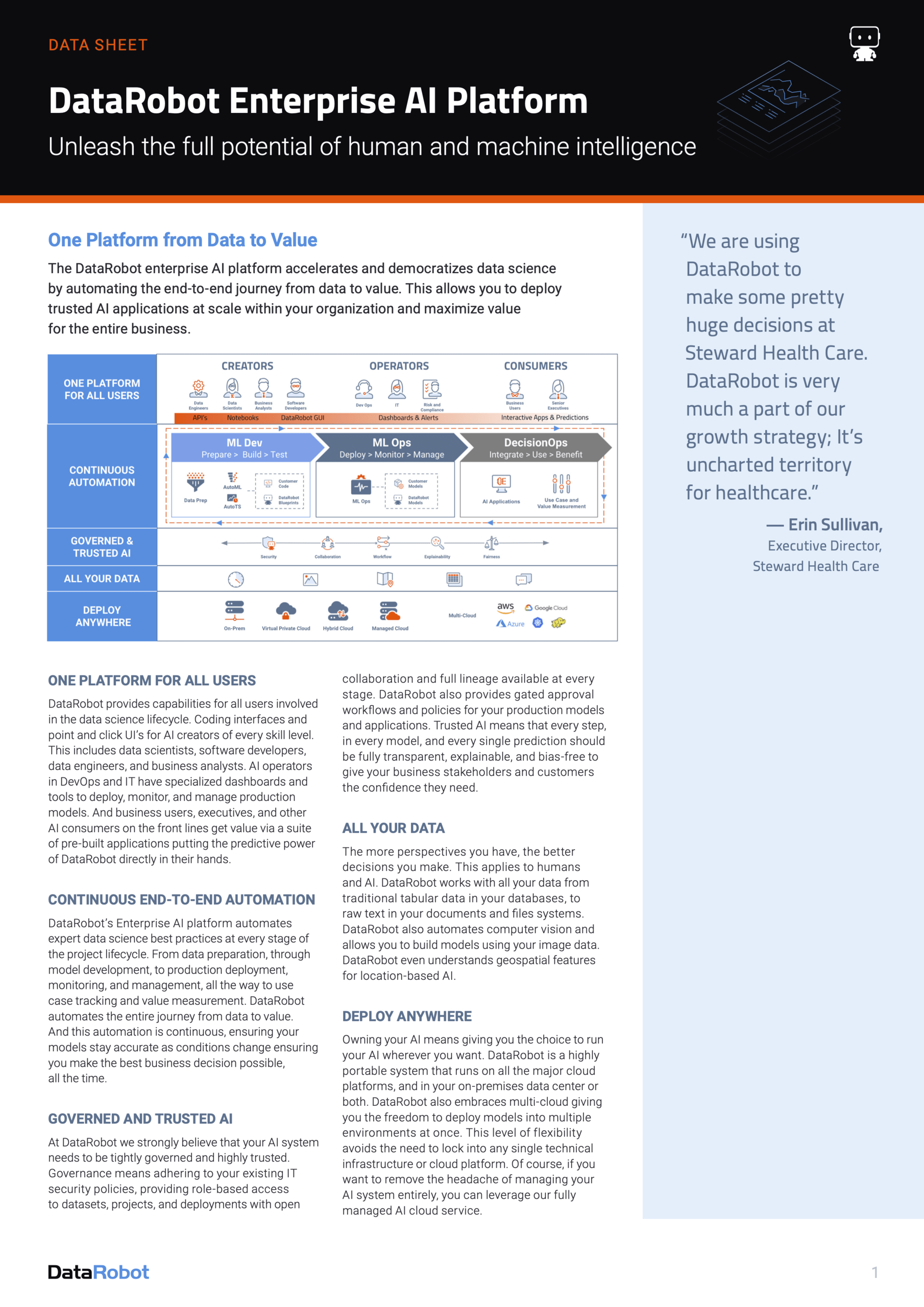

DataRobot is widely known for its products DataRobot Artificial Intelligence, DataRobot MLOps, DataRobot Core, DataRobot platform, and DataRobot AutoML. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from DataRobot are strong in the following areas, among others:

DataRobot is widely known for its products DataRobot Artificial Intelligence, DataRobot MLOps, DataRobot Core, DataRobot platform, and DataRobot AutoML. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from DataRobot are strong in the following areas, among others:

- artificial intelligence

- generative AI

- data science

- automated machine learning

- Python

- machine learning models

- reporting

- analytics

- time series

Figure 4: DataRobot Artificial Intelligence

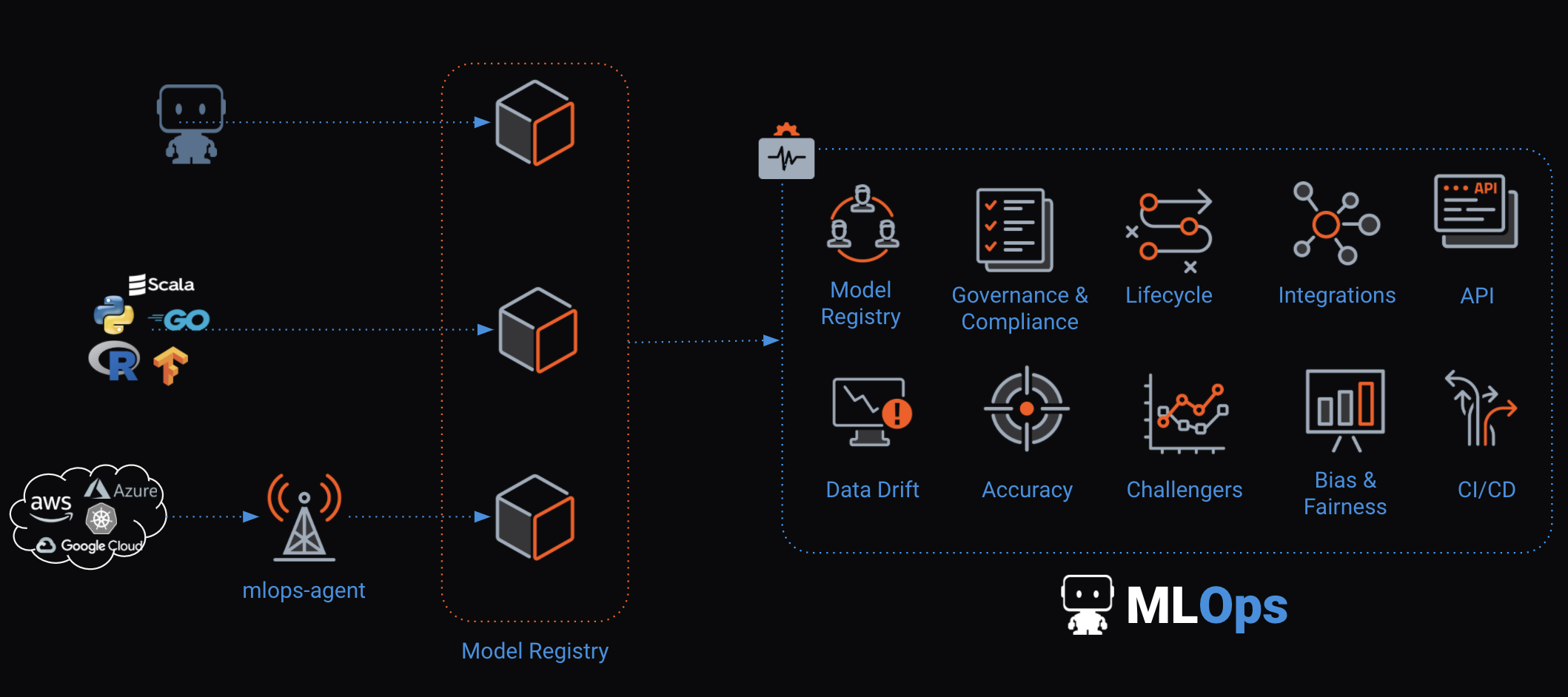

Figure 4: DataRobot Artificial Intelligence Figure 5: DataRobot MLOps

Figure 5: DataRobot MLOps Figure 6: DataRobot Core

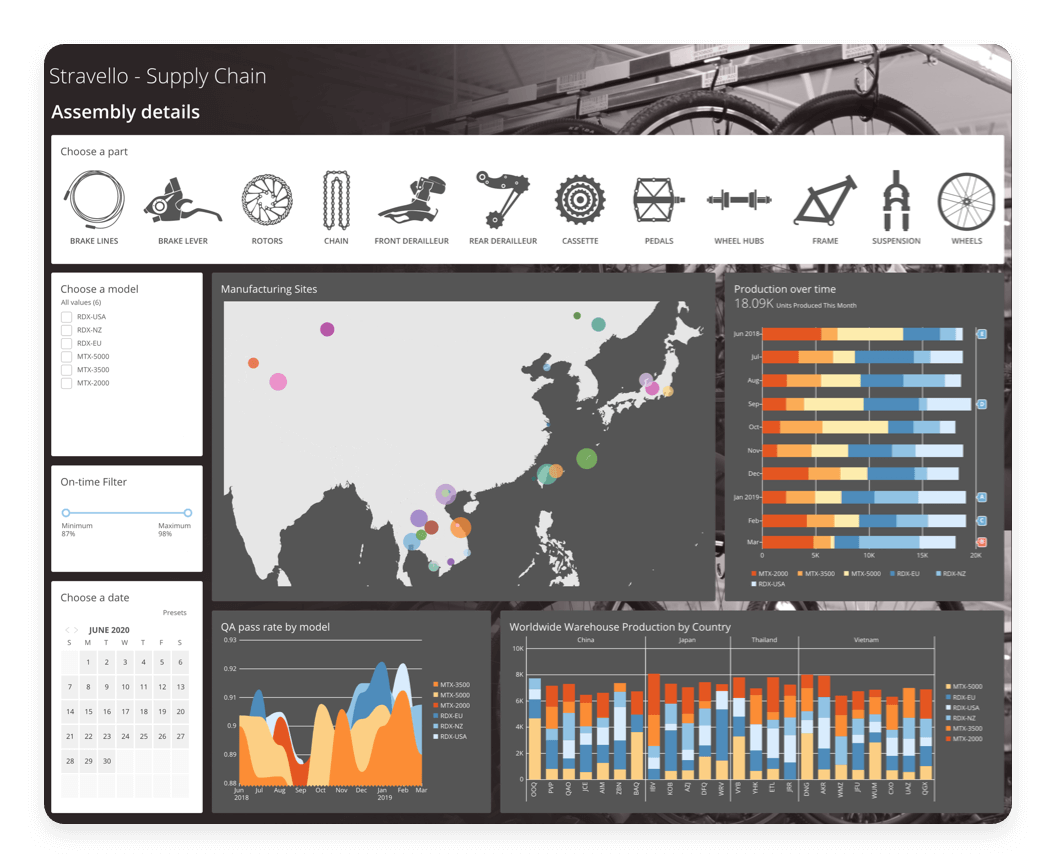

Figure 6: DataRobot Core3. Domo

- data science

- data visualization

- business intelligence

- analytics

- machine learning

- analysis

- real-time data

- dashboards

- tiles

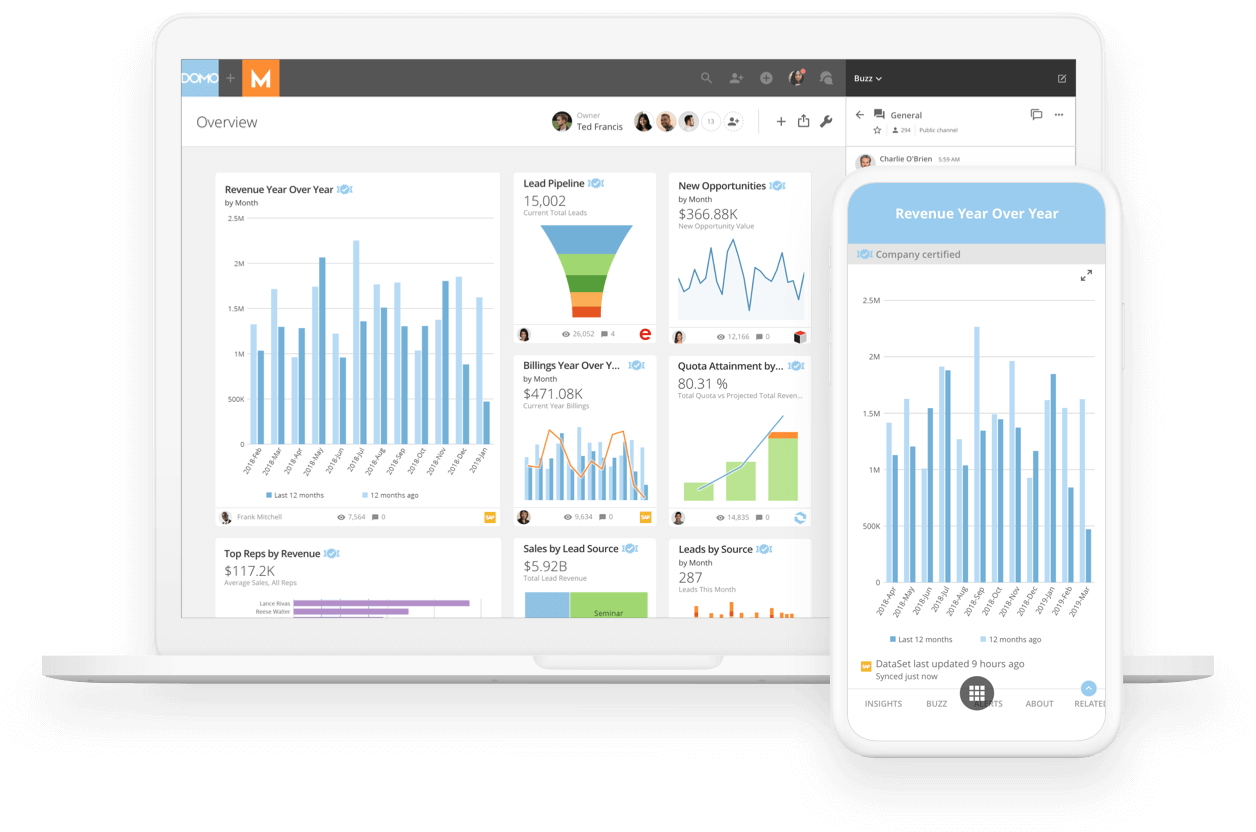

Figure 7: Domo Platform

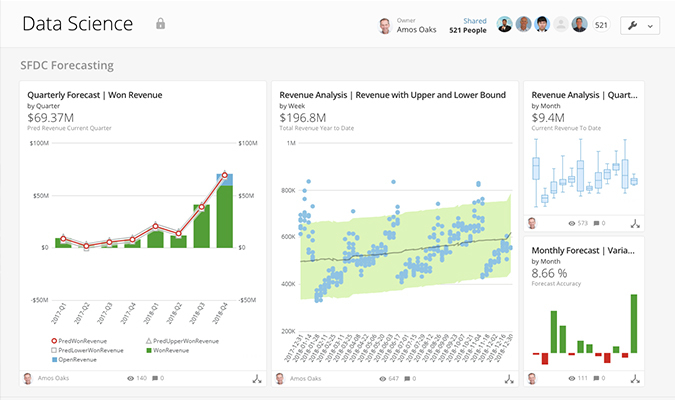

Figure 7: Domo Platform Figure 8: Domo Data Science

Figure 8: Domo Data Science Figure 9: Domo Business Intelligence

Figure 9: Domo Business Intelligence4. Dundas

The most well-known products in the area of BI & Analytics of the company Dundas are Dundas Data Visualization, Dundas Dashboard, and Dundas BI Data Flow. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Dundas can be characterized by good support on the following topics:

The most well-known products in the area of BI & Analytics of the company Dundas are Dundas Data Visualization, Dundas Dashboard, and Dundas BI Data Flow. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Dundas can be characterized by good support on the following topics:

- data visualization

- dashboards

- business intelligence

- reporting

- analytics platform

- analysis

- real-time

- data discovery

- interactive dashboards

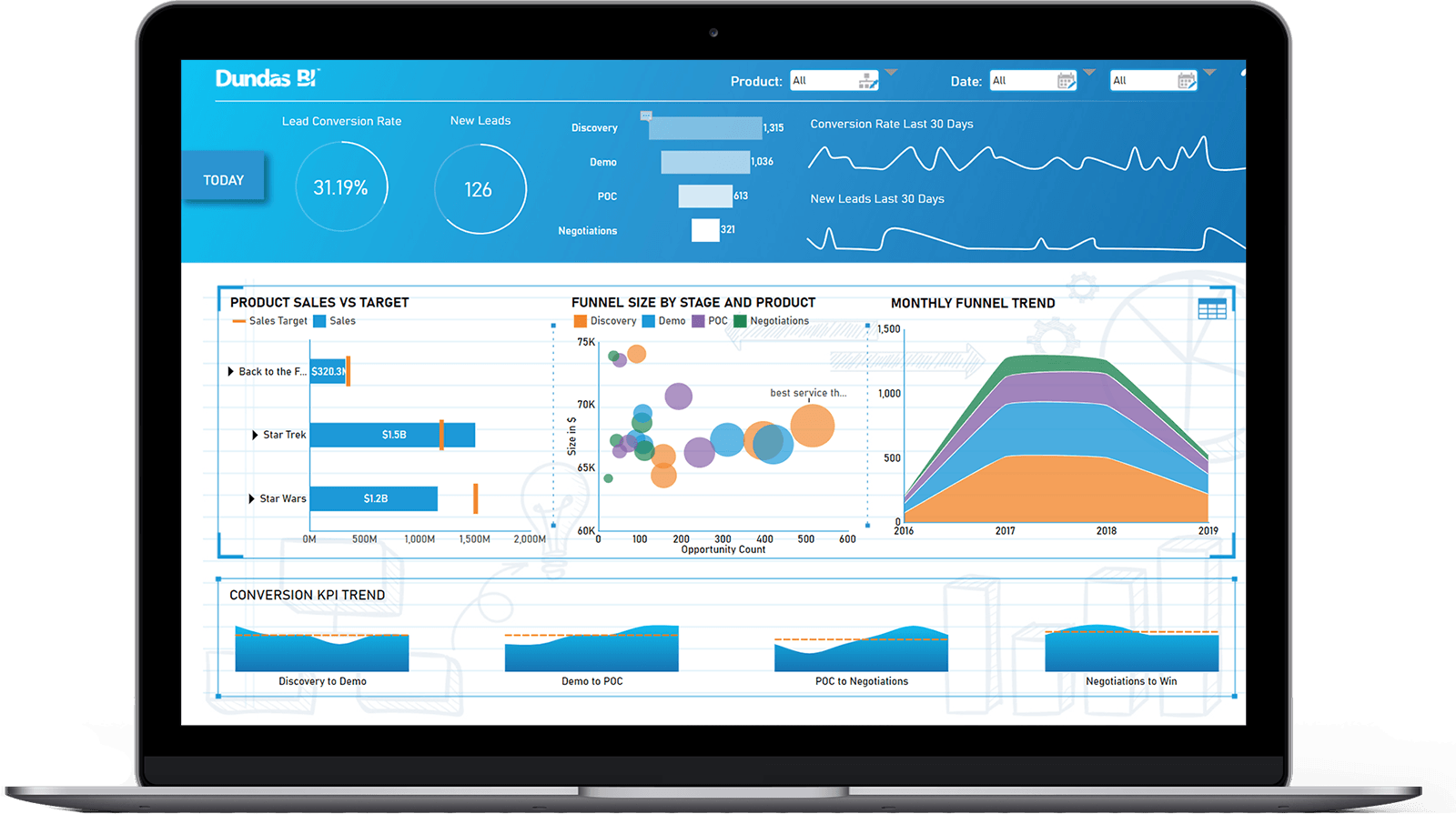

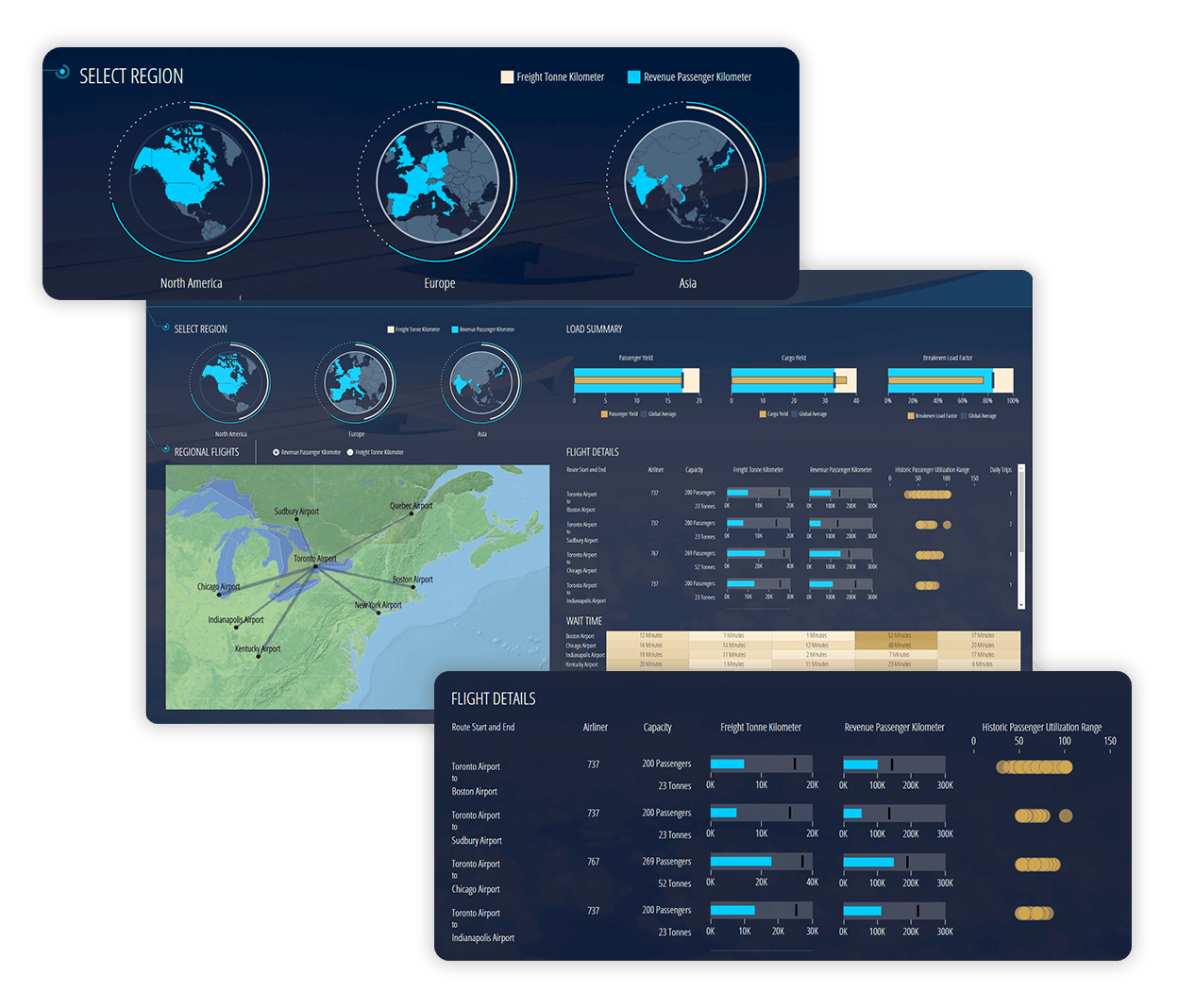

Figure 10: Dundas BI

Figure 10: Dundas BI Figure 11: Dundas Data Visualization

Figure 11: Dundas Data Visualization Figure 12: Dundas Dashboard

Figure 12: Dundas Dashboard5. GoodData

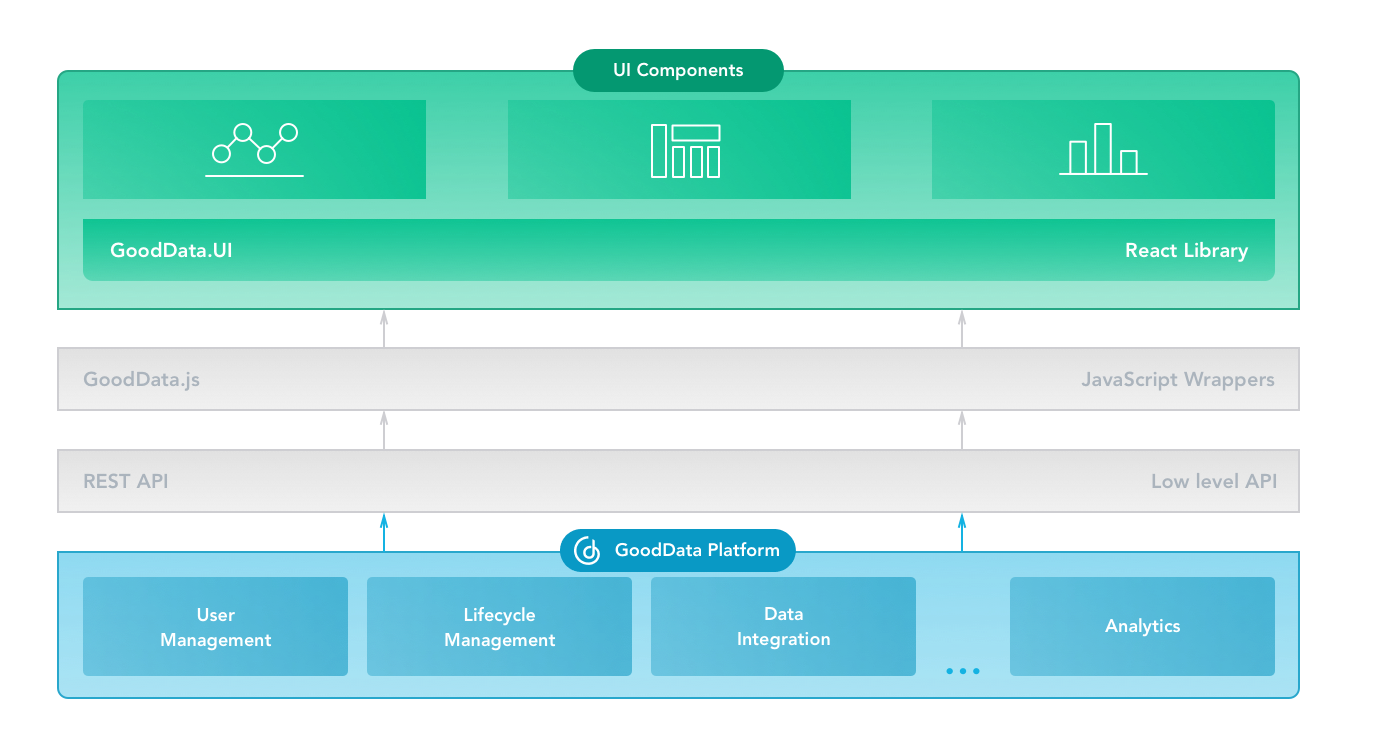

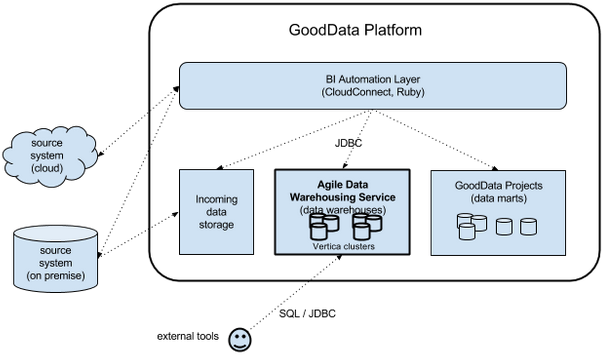

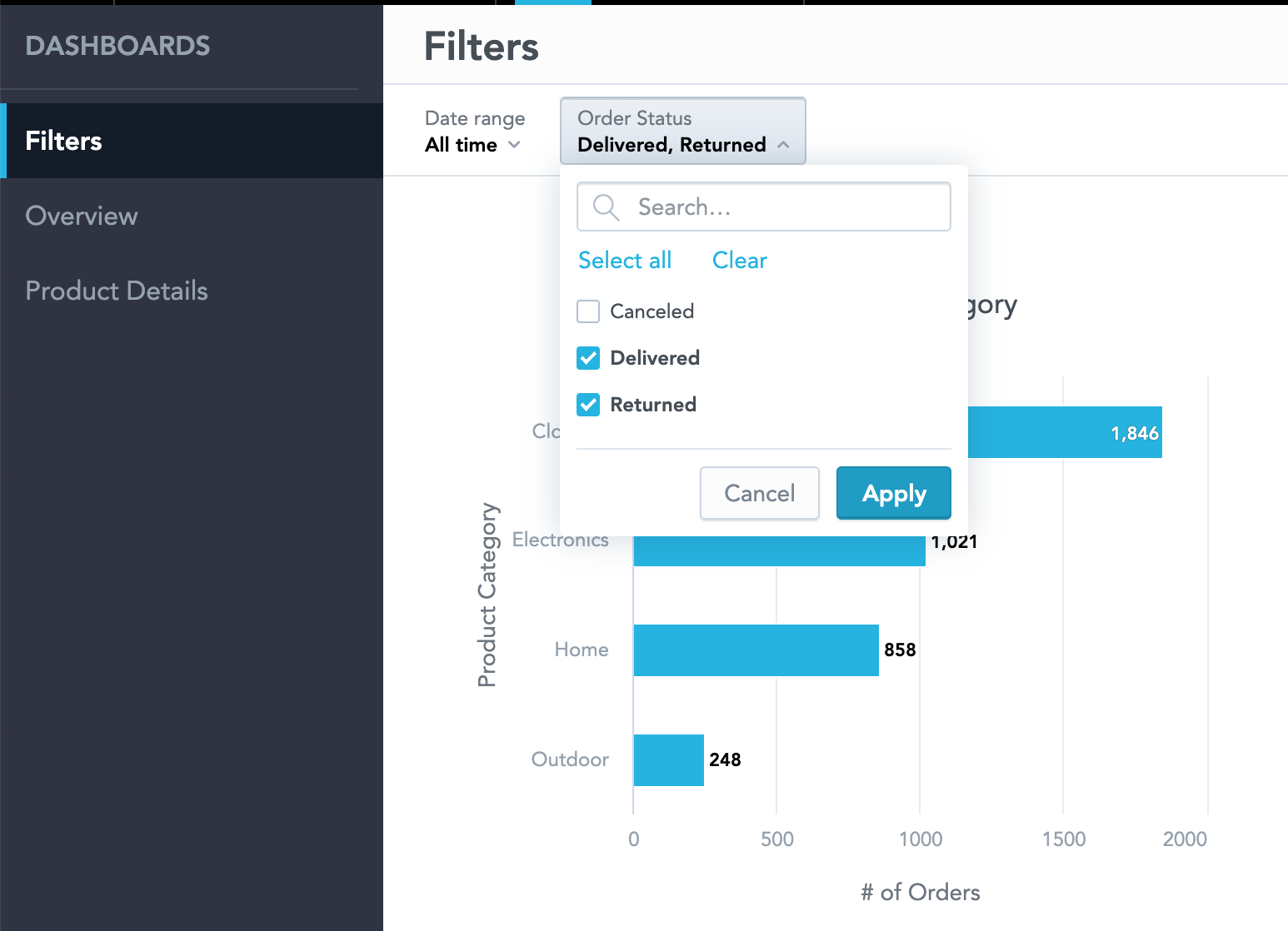

As far as we have been able to ascertain, GoodData currently has only one primary product: GoodData Platform. Take a look at the screen shots below. The Business Intelligence tools from GoodData are strong in the following areas, among others:

As far as we have been able to ascertain, GoodData currently has only one primary product: GoodData Platform. Take a look at the screen shots below. The Business Intelligence tools from GoodData are strong in the following areas, among others:

Figure 13: GoodData Platform

Figure 13: GoodData Platform Figure 14: GoodData Platform

Figure 14: GoodData Platform Figure 15: GoodData Platform

Figure 15: GoodData Platform6. IBM BI & Analytics

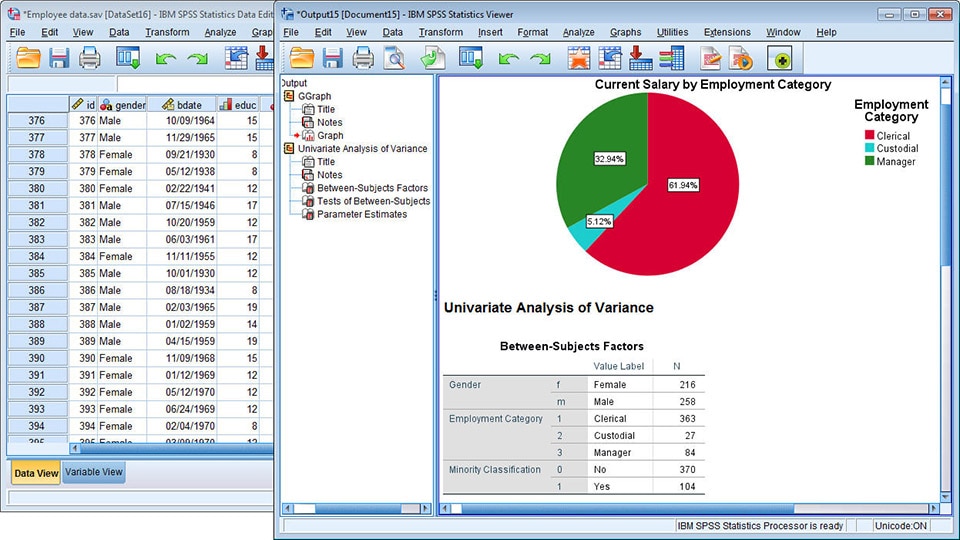

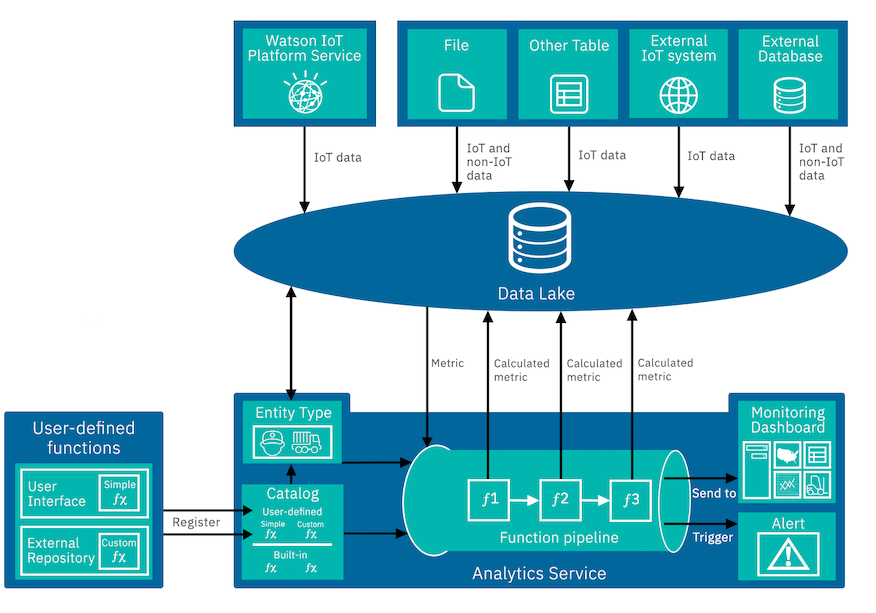

IBM is widely known for its products Cognos Analytics, IBM SPSS, IBM Watson, IBM Infosphere, and Netezza. Take a look at the images below. The Business Intelligence tools from IBM are strong in the following areas, among others:

IBM is widely known for its products Cognos Analytics, IBM SPSS, IBM Watson, IBM Infosphere, and Netezza. Take a look at the images below. The Business Intelligence tools from IBM are strong in the following areas, among others:

- analytics

- analysis

- real-time

- cube

- business intelligence

- IBM Netezza

- text analytics

- OLAP

- natural language processing

Figure 16: Cognos Analytics

Figure 16: Cognos Analytics Figure 17: IBM SPSS

Figure 17: IBM SPSS Figure 18: IBM Watson

Figure 18: IBM Watson7. Incorta

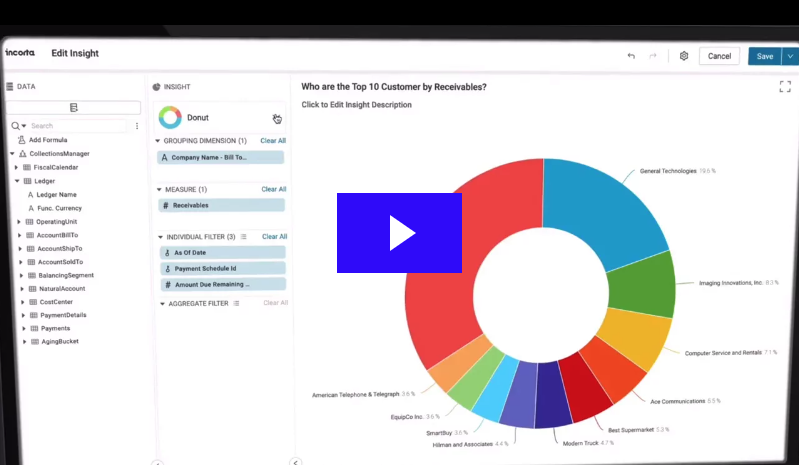

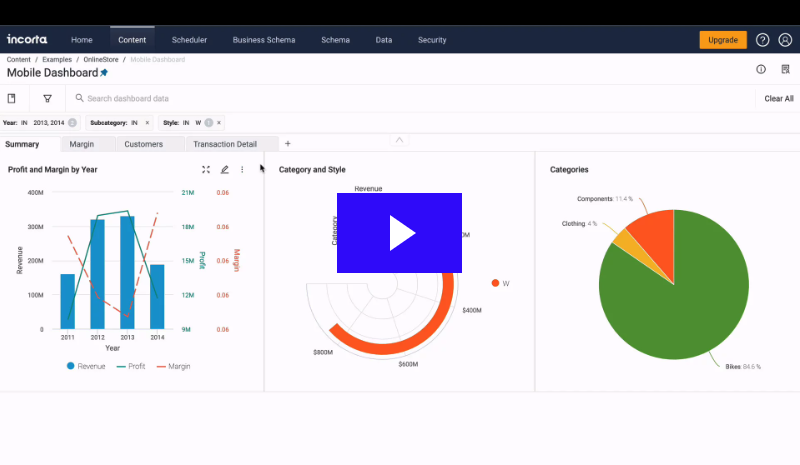

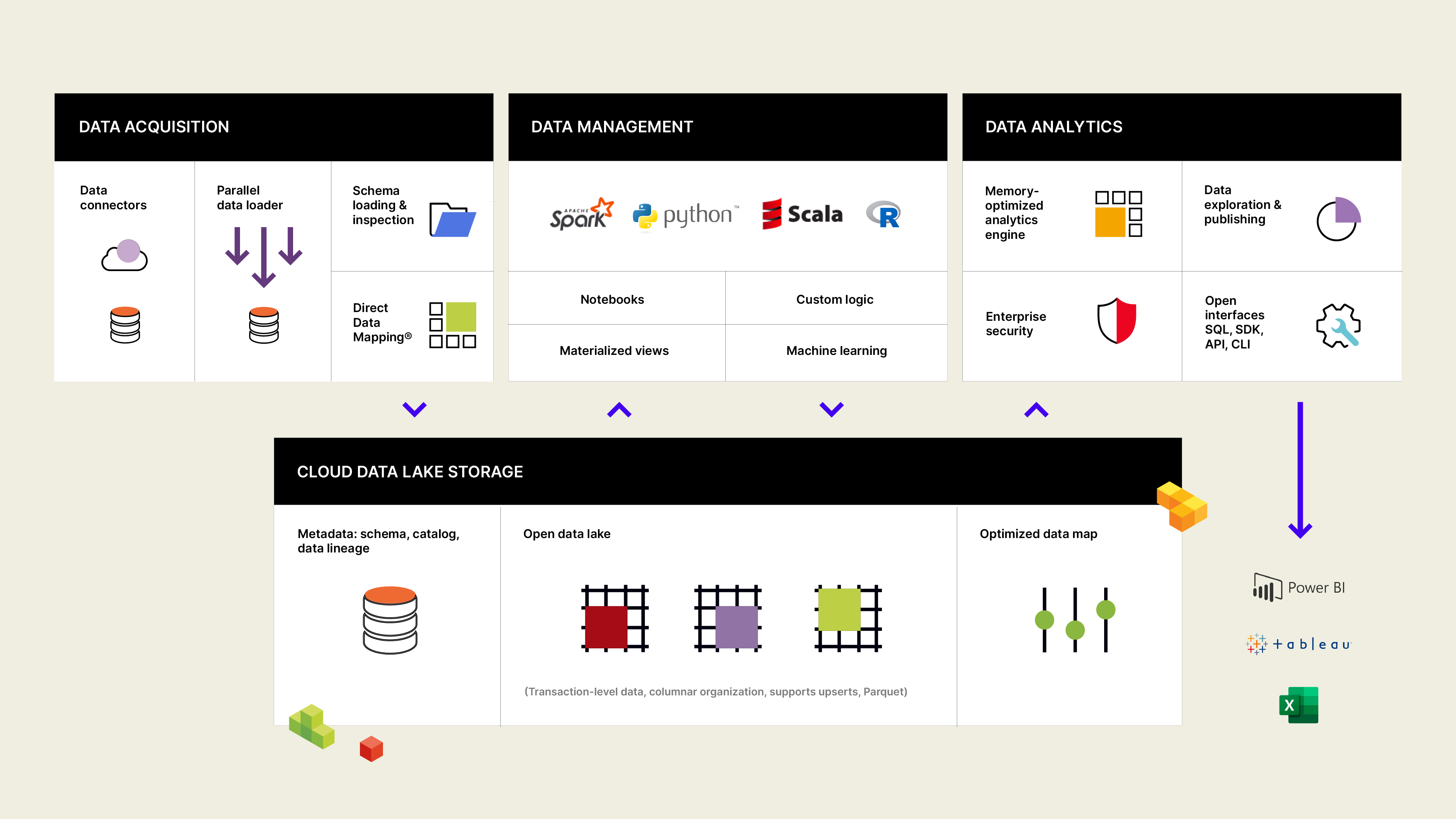

The most well-known products in the area of BI & Analytics of the company Incorta are Incorta Analytics, and Incorta analyzer. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Incorta can be characterized by good support on the following topics:

The most well-known products in the area of BI & Analytics of the company Incorta are Incorta Analytics, and Incorta analyzer. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Incorta can be characterized by good support on the following topics:

- analytics platform

- reporting

- dashboards

- analysis

- real-time

- business intelligence

- data science

- data hub

- data management

Figure 19: Incorta Analytics

Figure 19: Incorta Analytics Figure 20: Incorta Analytics

Figure 20: Incorta Analytics Figure 21: Incorta Analytics

Figure 21: Incorta Analytics8. InetSoft

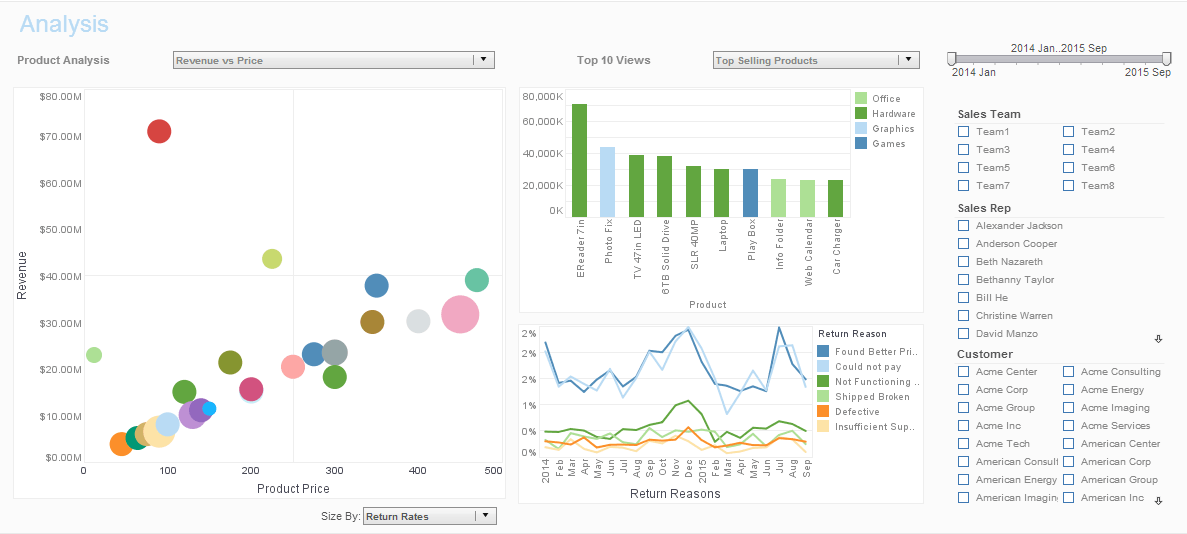

![]() InetSoft is widely known for its products InetSoft Style Intelligence, InetSoft Business Intelligence, InetSoft Data Intelligence, InetSoft Style Studio, and InetSoft Data Cleansing. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from InetSoft are strong in the following areas, among others:

InetSoft is widely known for its products InetSoft Style Intelligence, InetSoft Business Intelligence, InetSoft Data Intelligence, InetSoft Style Studio, and InetSoft Data Cleansing. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from InetSoft are strong in the following areas, among others:

- business intelligence

- analytics

- reporting

- dashboards

- analysis

- big data

- data discovery

- data visualization

- data modeling

- cloud computing

Figure 22: InetSoft Style Intelligence

Figure 22: InetSoft Style Intelligence Figure 23: InetSoft Business Intelligence

Figure 23: InetSoft Business Intelligence9. Infor BI & Analytics

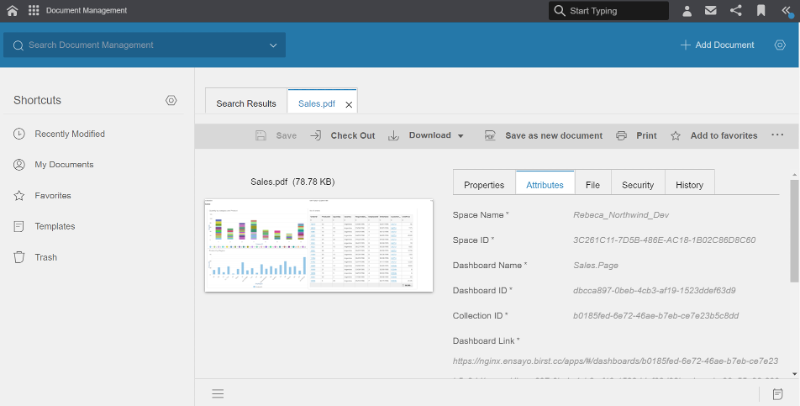

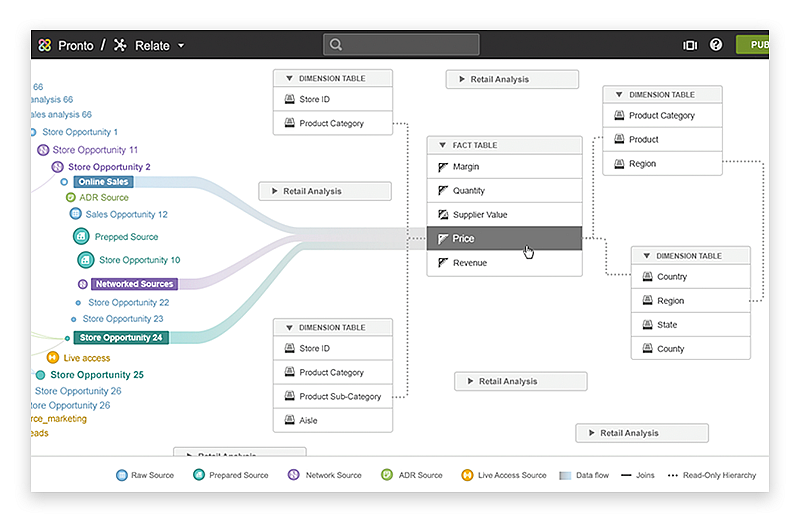

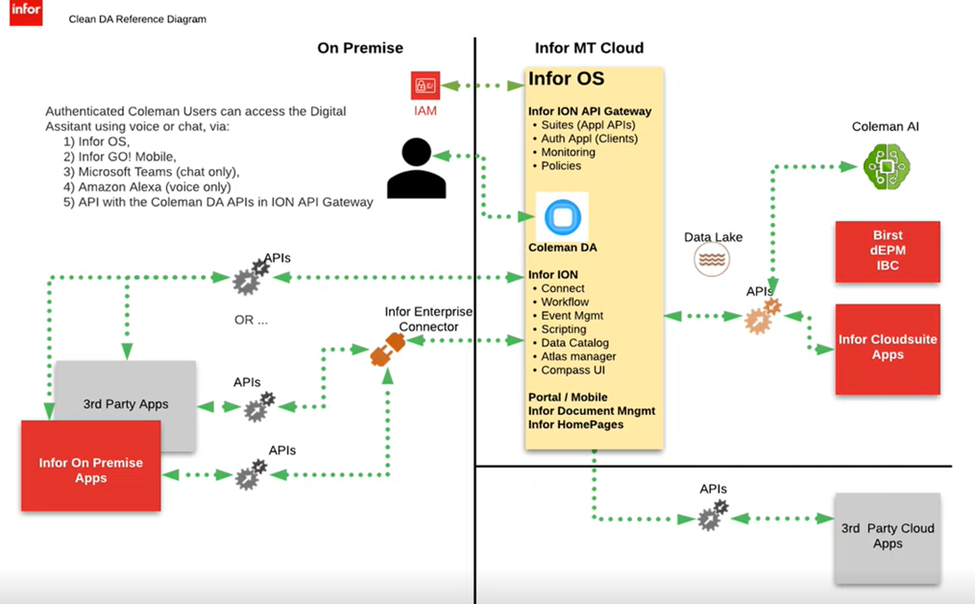

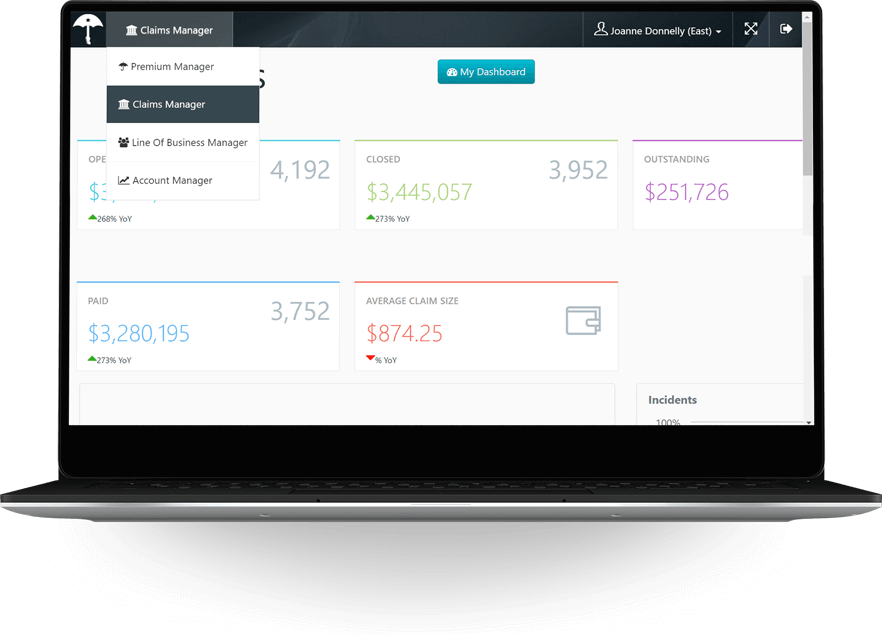

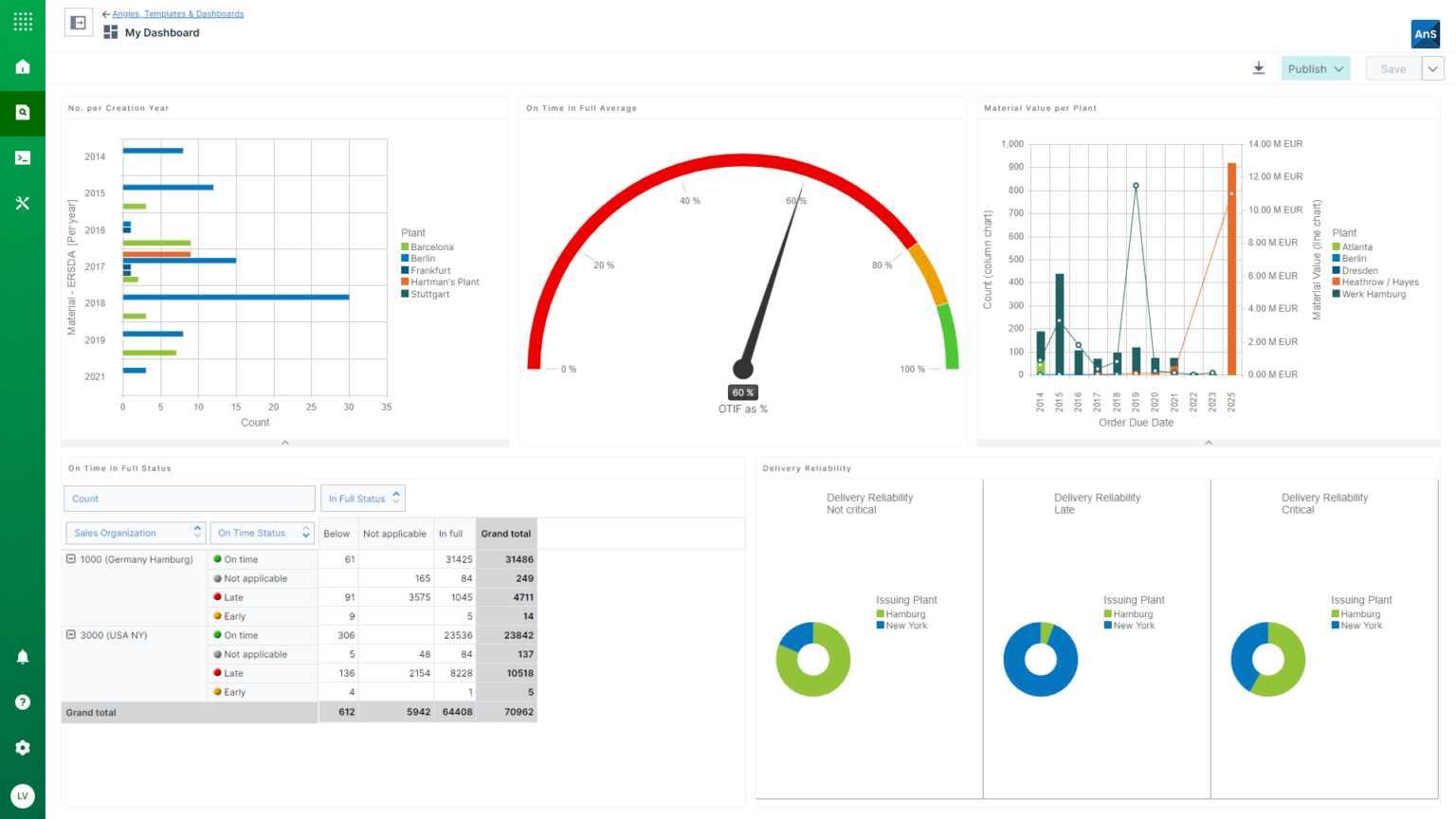

Infor is widely known for its products Infor Birst, Infor BI, Infor Landmark, and Infor Coleman AI. Take a look at the images below. The Business Intelligence tools from Infor are strong in the following areas, among others:

Infor is widely known for its products Infor Birst, Infor BI, Infor Landmark, and Infor Coleman AI. Take a look at the images below. The Business Intelligence tools from Infor are strong in the following areas, among others:

- reporting

- IoT

- dashboards

- business intelligence

- machine learning

- artificial intelligence

- analysis

- analytics platform

- Microsoft Teams

Figure 25: Infor Birst

Figure 25: Infor Birst Figure 26: Infor BI

Figure 26: Infor BI Figure 27: Infor Coleman

Figure 27: Infor Coleman10. insightssoftware BI & Analytics

The most well-known products in the area of BI & Analytics of the company insightssoftware are Logi Info, Logi Composer, Logi Report Server, Logi Predict, and Logi Report Designer. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from insightssoftware can be characterized by good support on the following topics:

The most well-known products in the area of BI & Analytics of the company insightssoftware are Logi Info, Logi Composer, Logi Report Server, Logi Predict, and Logi Report Designer. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from insightssoftware can be characterized by good support on the following topics:

- analytics platform

- embedded analytics

- reporting

- dashboards

- java

- performance management

- business intelligence

- interactive dashboards

- Windows

Figure 28: Logi Info

Figure 28: Logi Info Figure 29: Logi Composer

Figure 29: Logi Composer Figure 30: Logi Report Server

Figure 30: Logi Report Server11. Looker

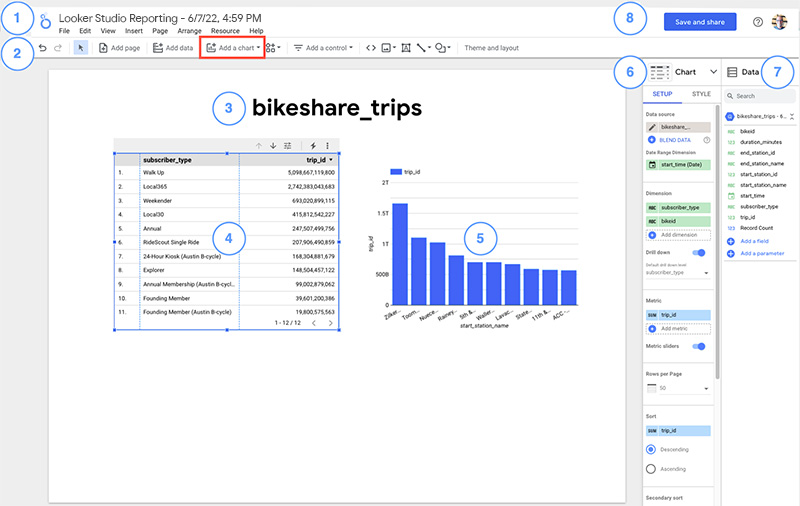

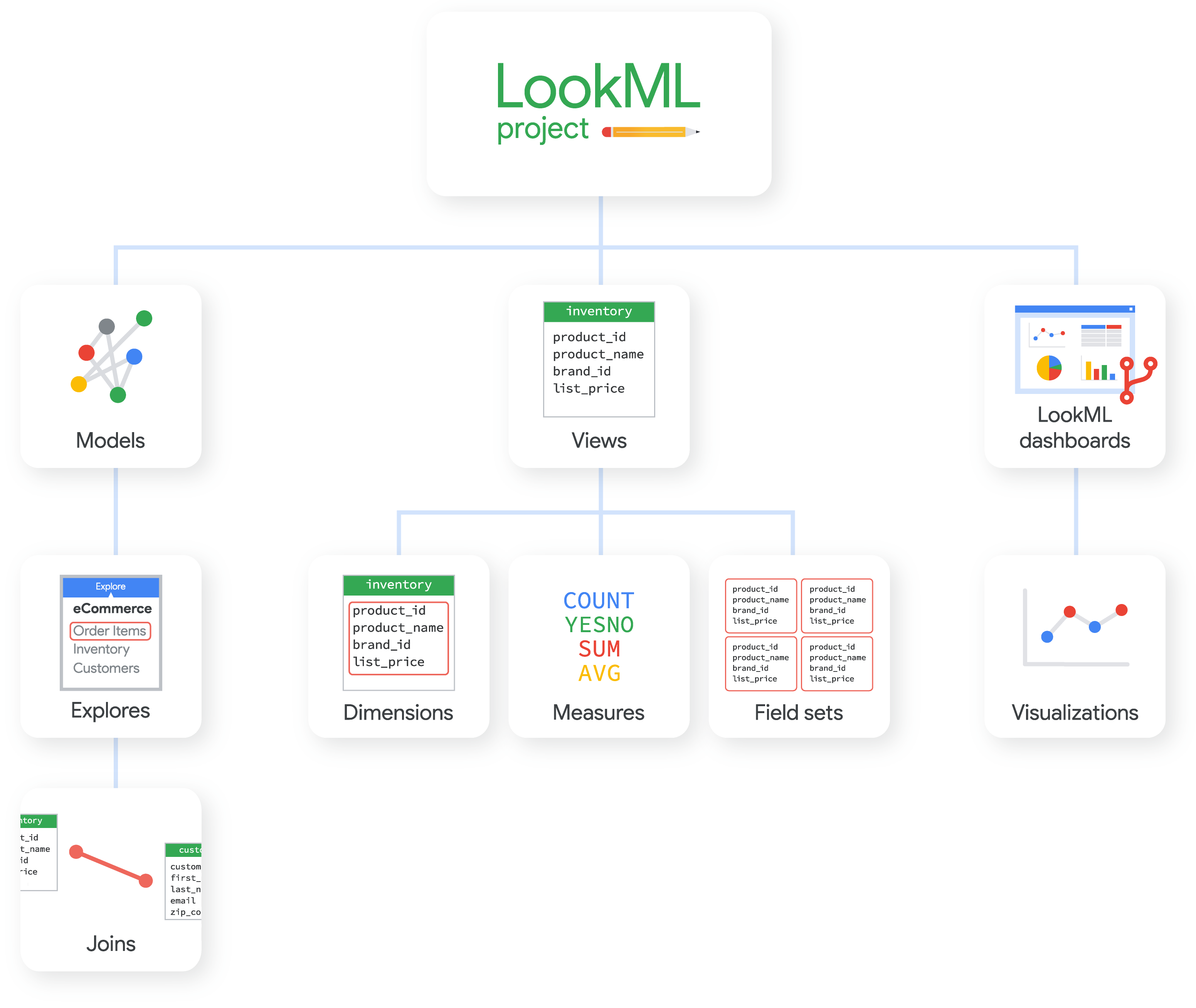

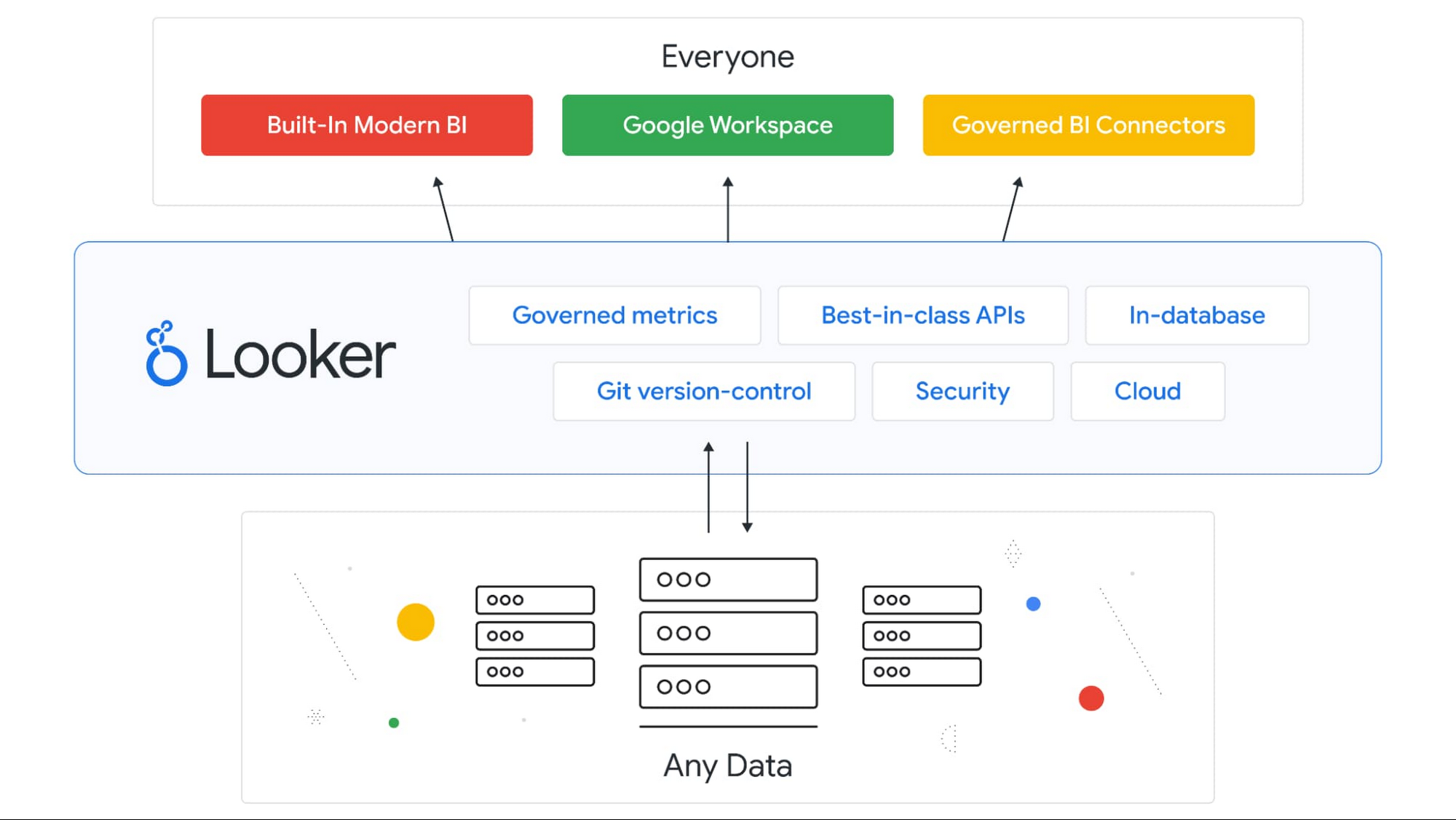

Looker is widely known for its products Looker Studio, Looker API, LookML Dashboards, and Looker Blocks. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from Looker are strong in the following areas, among others:

Looker is widely known for its products Looker Studio, Looker API, LookML Dashboards, and Looker Blocks. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from Looker are strong in the following areas, among others:

- dashboards

- SQL

- embedded analytics

- business intelligence

- analysis

- Google Analytics

- analytics platform

- web analytics

- marketing analytics

Figure 31: Looker Studio

Figure 31: Looker Studio Figure 32: LookML

Figure 32: LookML Figure 33: Looker API

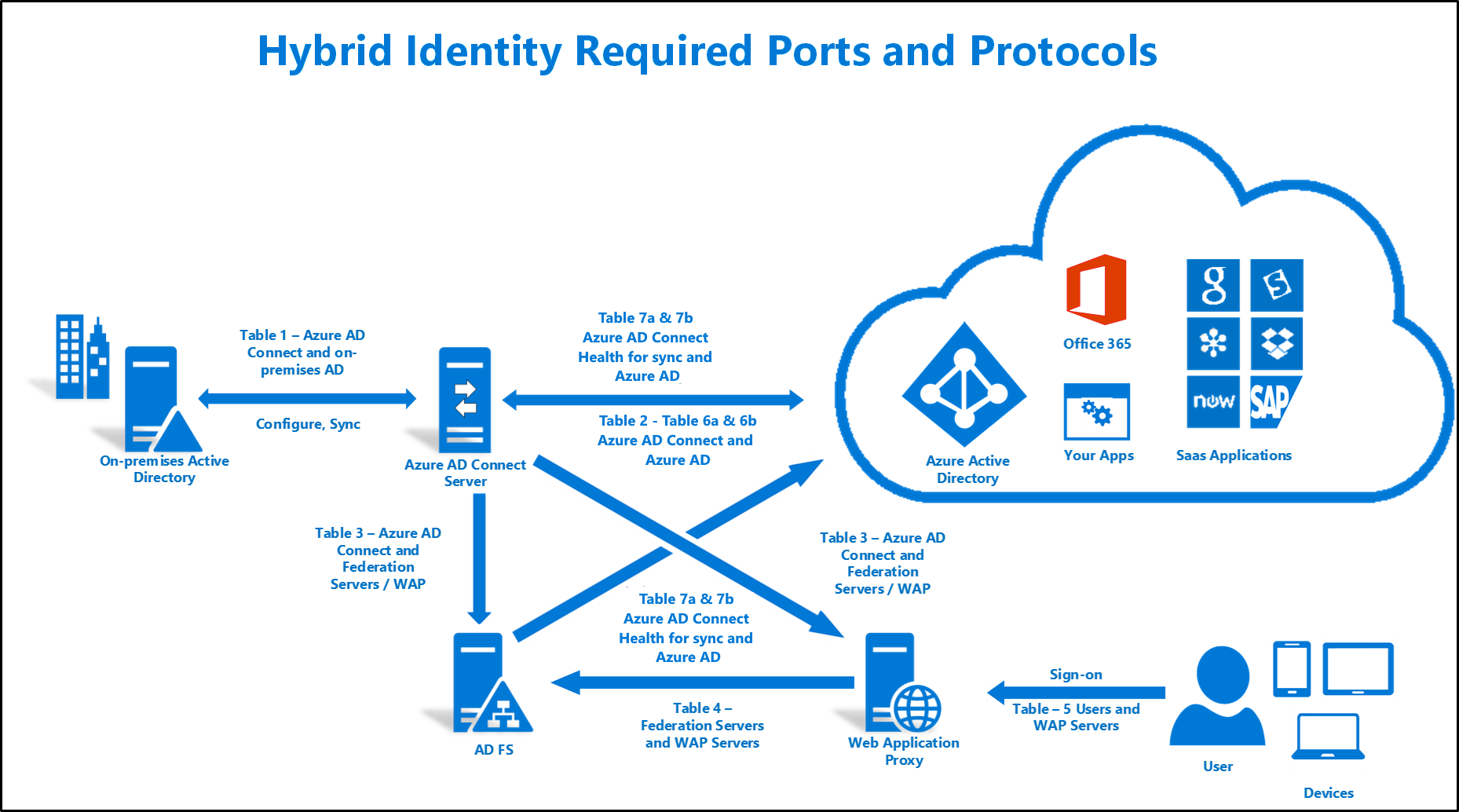

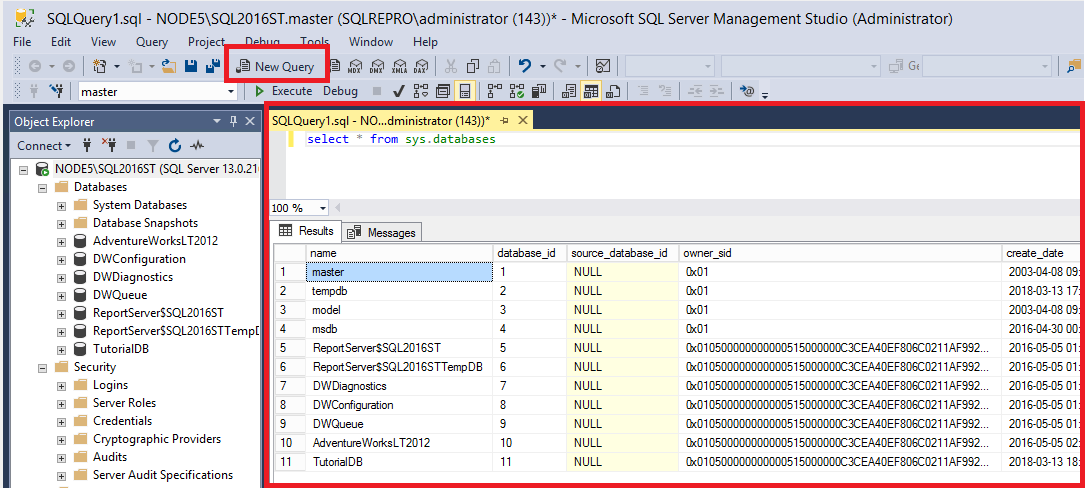

Figure 33: Looker API12. Microsoft BI & Analytics

The Business Intelligence tools from the BI & Analytics vendor Microsoft focus on the support of the following functionalities:

The Business Intelligence tools from the BI & Analytics vendor Microsoft focus on the support of the following functionalities:

- SQL

- analytics

- R

- reporting

- analysis

- IoT

- data mining

- Windows

- machine learning server

Microsoft serves the market with the following products, among others: Power BI, Microsoft Azure, Microsoft SQL Server, Azure Synapse Analytics, and Azure Stream Analytics (see the images below). We took a closer look at them.

Figure 34: Power BI

Figure 34: Power BI Figure 35: Microsoft Azure

Figure 35: Microsoft Azure Figure 36: Microsoft SQL Server

Figure 36: Microsoft SQL Server13. Oracle BI & Analytics

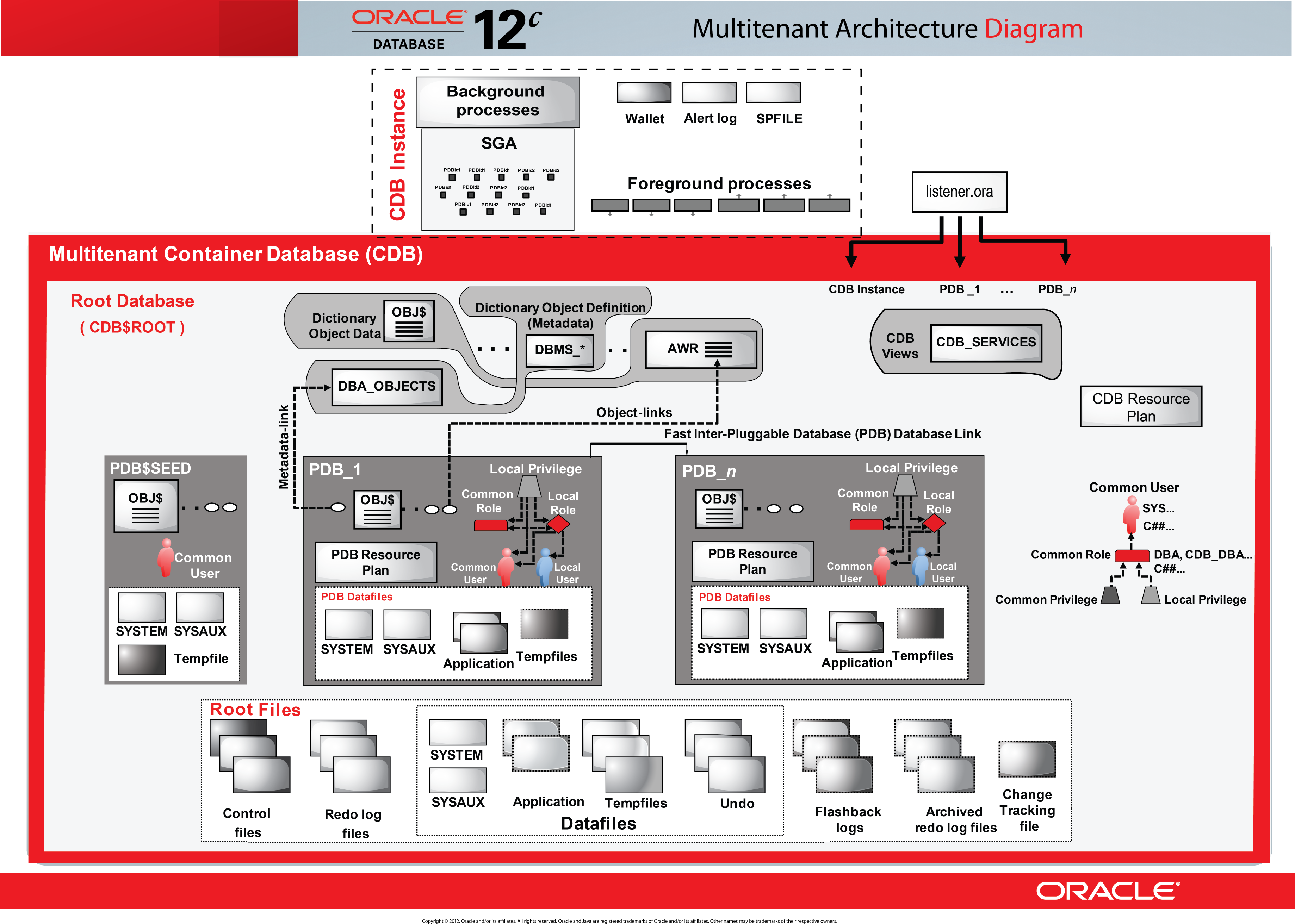

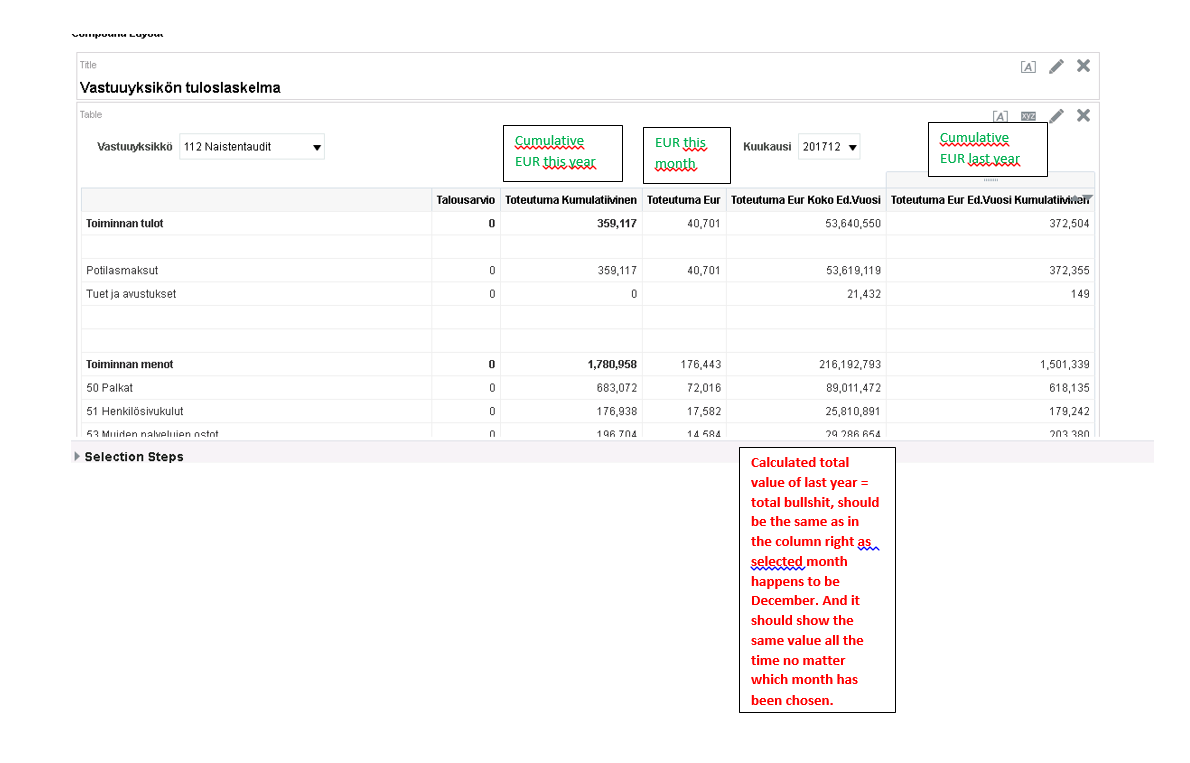

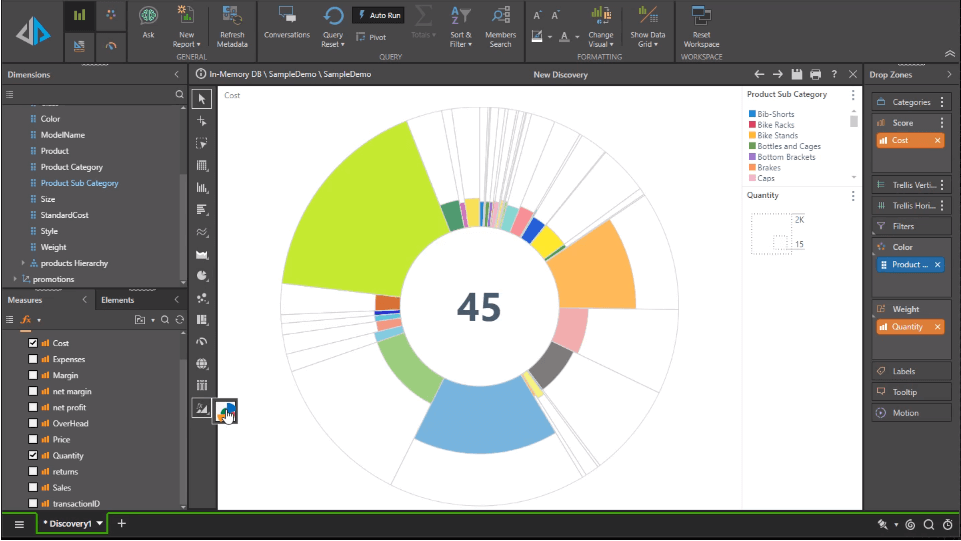

The most well-known products in the area of BI & Analytics of the company Oracle are Oracle Database, OBIEE, Oracle Big Data, and Oracle Analytics Server. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Oracle can be characterized by good support on the following topics:

The most well-known products in the area of BI & Analytics of the company Oracle are Oracle Database, OBIEE, Oracle Big Data, and Oracle Analytics Server. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Oracle can be characterized by good support on the following topics:

- analytics

- business intelligence

- SQL

- data quality

- big data appliance

- data management

- R

- data science

- analysis

Figure 37: Oracle Analytics

Figure 37: Oracle Analytics Figure 38: Oracle Database

Figure 38: Oracle Database Figure 39: OBIEE

Figure 39: OBIEE14. Pyramid Analytics

- analytics

- decision intelligence

- business intelligence

- data science

- forecasting

- data discovery

- data preparation

- Python

- analysis

- repository

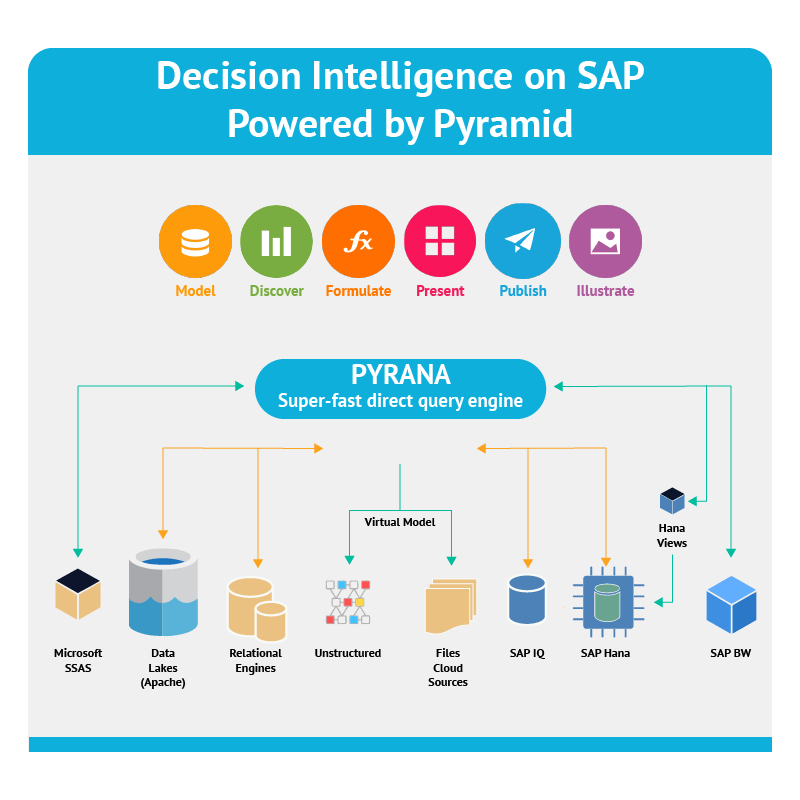

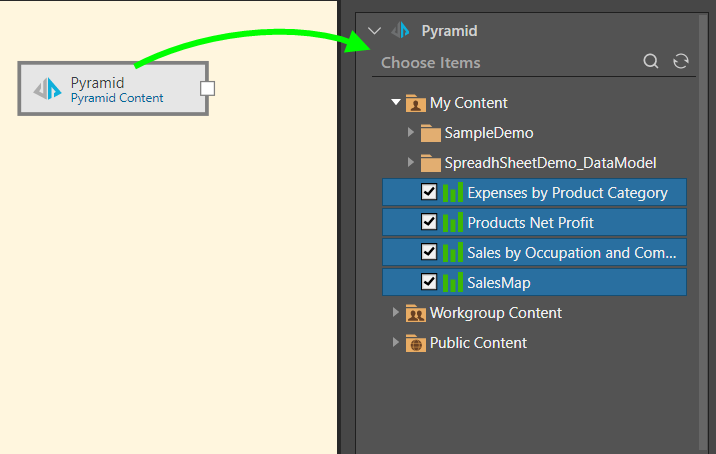

Figure 40: Pyramid Analytics

Figure 40: Pyramid Analytics Figure 41: Pyramid Decision Intelligence Platform

Figure 41: Pyramid Decision Intelligence Platform Figure 42: Pyramid Data Science Workbench

Figure 42: Pyramid Data Science Workbench15. Qlik

Qlik is widely known for its products QlikView, Qlik Sense Enterprise, Qlik Replicate, and Qlik NPrinting. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from Qlik are strong in the following areas, among others:

Qlik is widely known for its products QlikView, Qlik Sense Enterprise, Qlik Replicate, and Qlik NPrinting. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from Qlik are strong in the following areas, among others:

- geoanalytics

- Windows

- reporting

- big data

- analytics platform

- analysis

- SaaS

- data integration platform

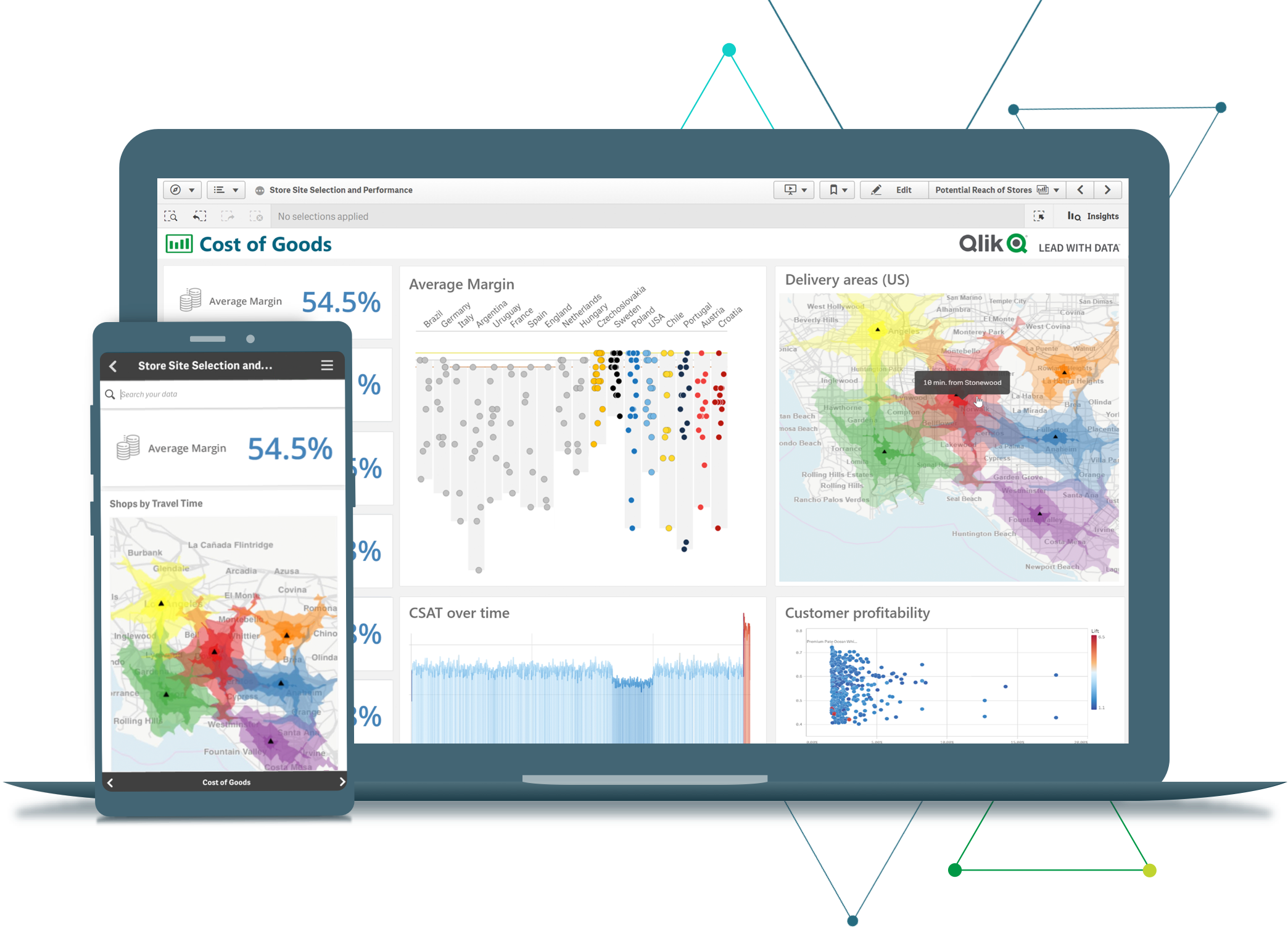

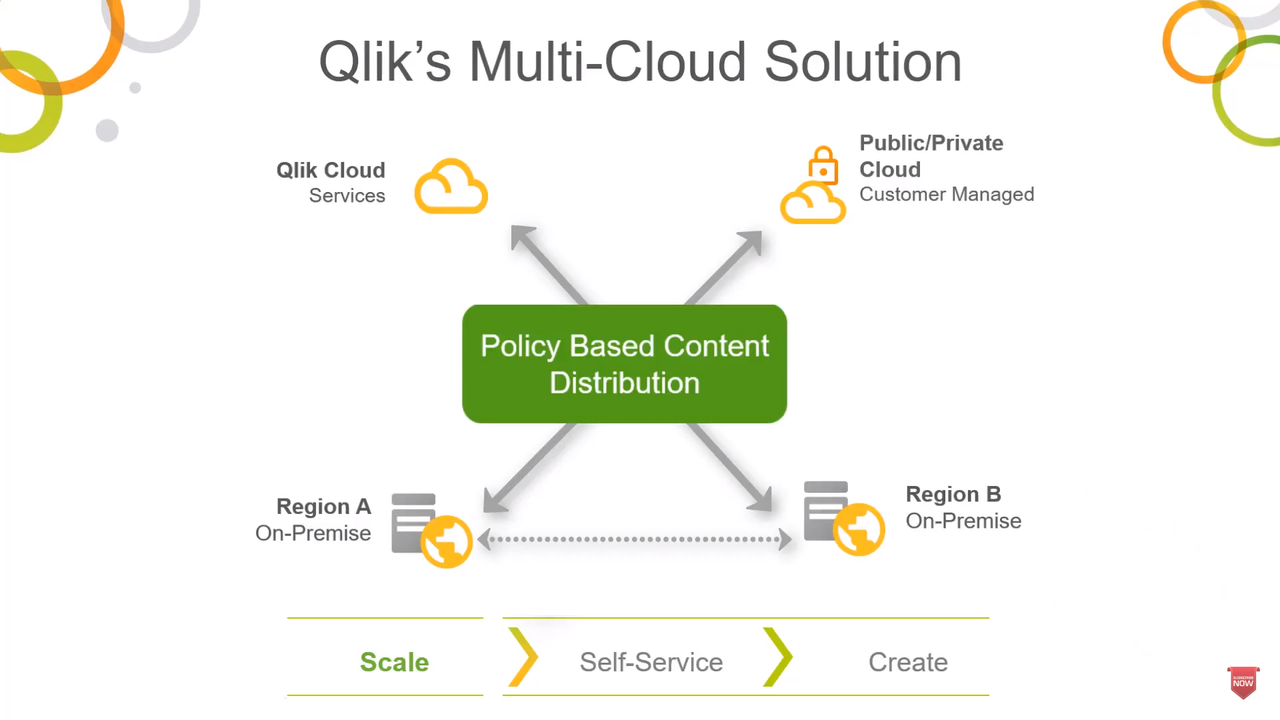

Figure 43: Qlik Sense

Figure 43: Qlik Sense Figure 44: QlikView

Figure 44: QlikView Figure 45: Qlik Sense Enterprise

Figure 45: Qlik Sense Enterprise16. SAP BI & Analytics

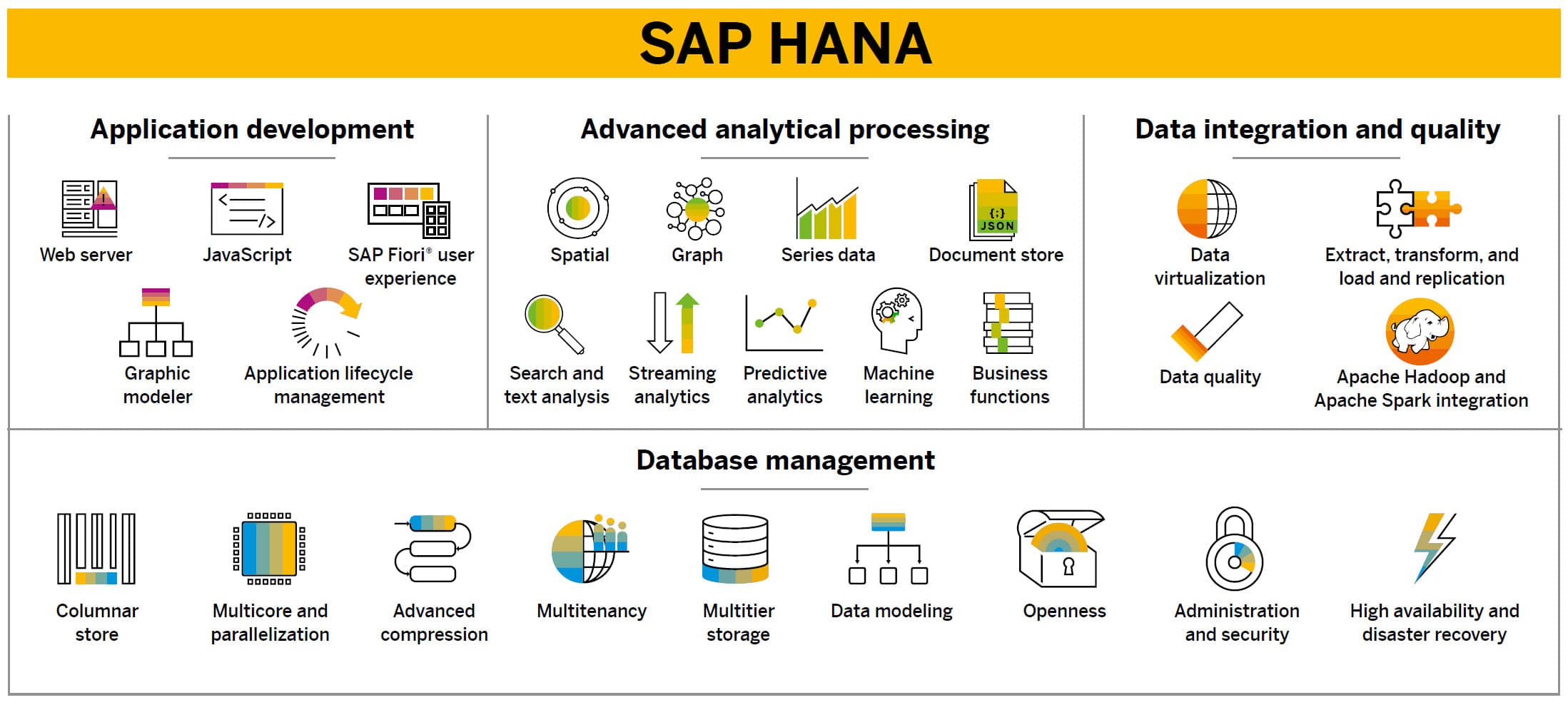

The Business Intelligence tools from the BI & Analytics vendor SAP focus on the support of the following functionalities:

The Business Intelligence tools from the BI & Analytics vendor SAP focus on the support of the following functionalities:

- analytics

- business intelligence

- analysis

- dashboards

- machine learning

- reporting

- predictive analytics

- data management

- data hub

- SQL

SAP serves the market with the following products, among others: SAP HANA, SAP Analytics Cloud, SAP BusinessObjects, and SAP BW (see the images below). We took a closer look at them.

Figure 46: SAP HANA

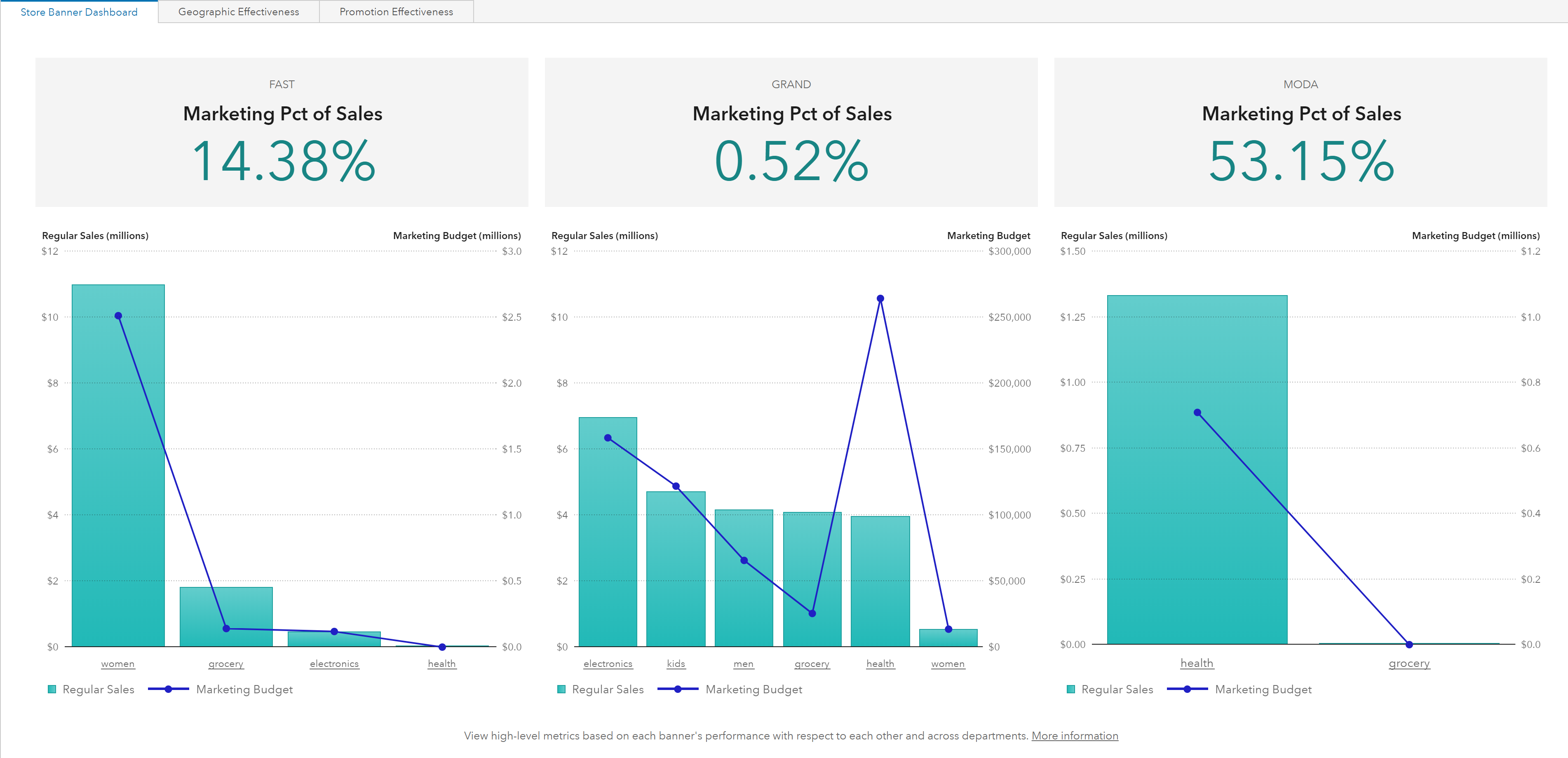

Figure 46: SAP HANA Figure 47: SAP Analytics Cloud

Figure 47: SAP Analytics Cloud Figure 48: SAP BusinessObjects

Figure 48: SAP BusinessObjects17. SAS

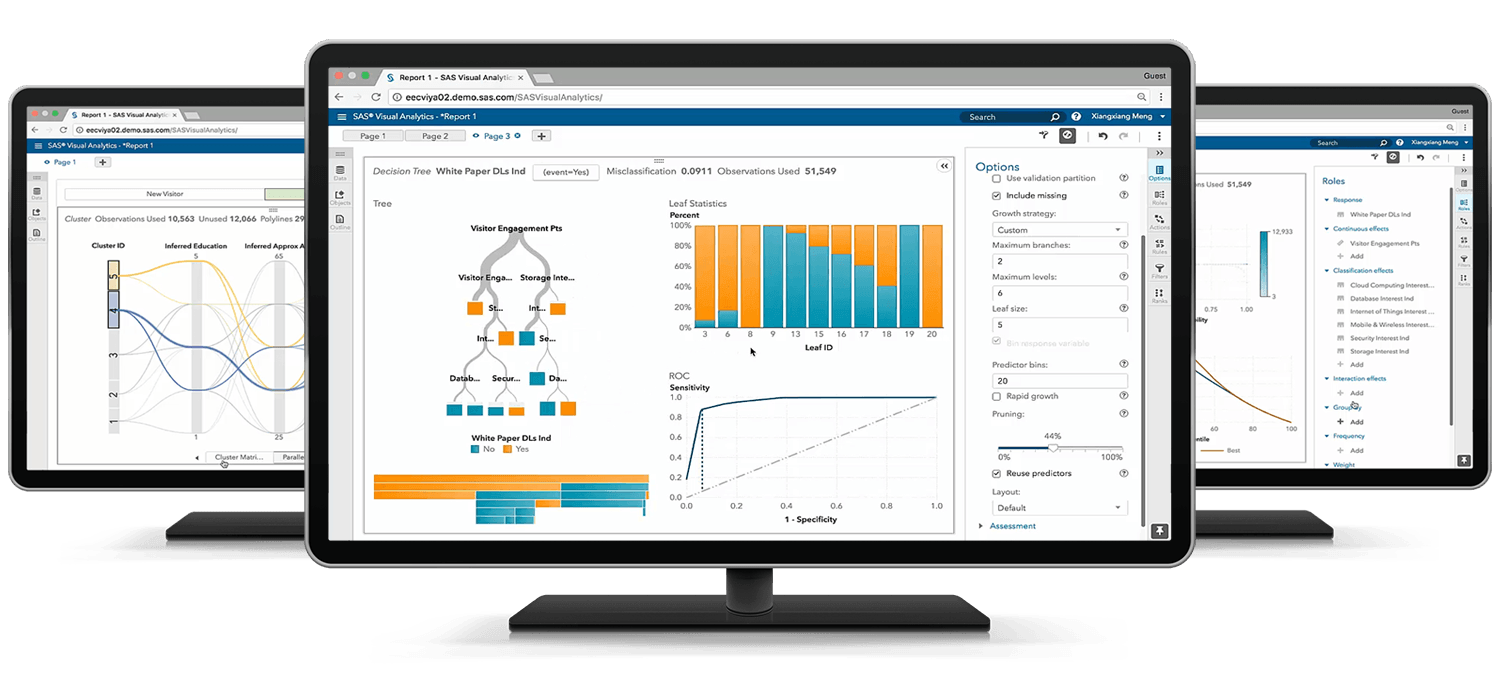

SAS is widely known for its products SAS Viya, SAS Visual Analytics, Dataflux, SAS/ACCESS, and SAS Enterprise Guide. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from SAS are strong in the following areas, among others:

SAS is widely known for its products SAS Viya, SAS Visual Analytics, Dataflux, SAS/ACCESS, and SAS Enterprise Guide. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from SAS are strong in the following areas, among others:

- analytics

- visual analytics

- forecasting

- data management

- data integration

- OLAP

- analysis

- data quality

- machine learning

- customer intelligence

Figure 49: SAS Viya

Figure 49: SAS Viya Figure 50: SAS Visual Analytics

Figure 50: SAS Visual Analytics Figure 51: Dataflux

Figure 51: Dataflux18. Sisense

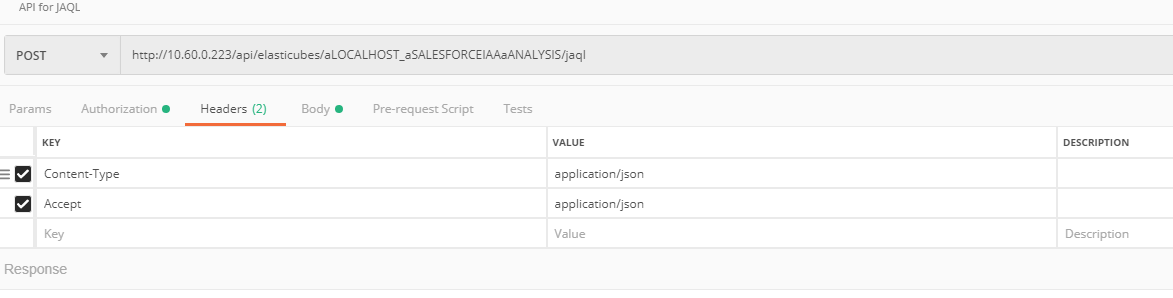

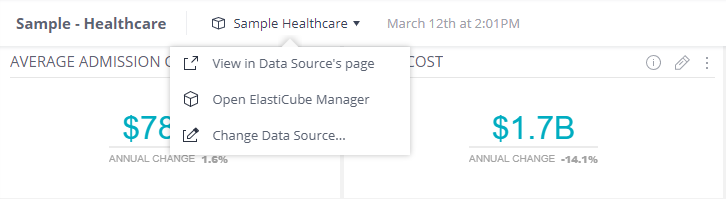

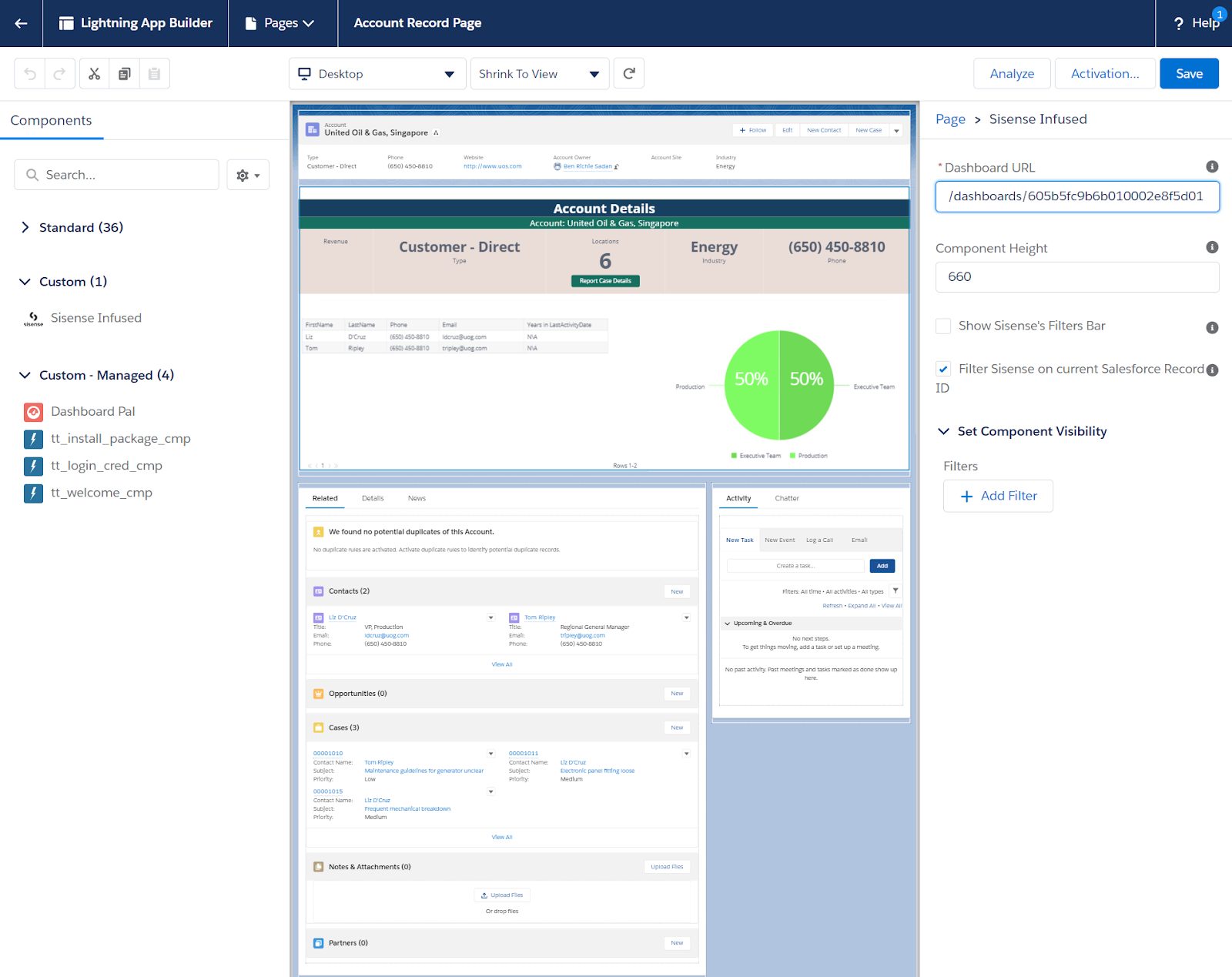

Sisense is widely known for its products Elasticube Manager, Sisense Analytics, Sisense ElastiCube, and Sisense Blox. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from Sisense are strong in the following areas, among others:

Sisense is widely known for its products Elasticube Manager, Sisense Analytics, Sisense ElastiCube, and Sisense Blox. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from Sisense are strong in the following areas, among others:

- dashboards

- business intelligence

- embedded analytics

- analytics platform

- data mining

- usage analytics

- predictive analytics

- forecasting

- complex data

Figure 52: Elasticube

Figure 52: Elasticube Figure 53: Elasticube Manager

Figure 53: Elasticube Manager Figure 54: Sisense Analytics

Figure 54: Sisense Analytics19. Tableau

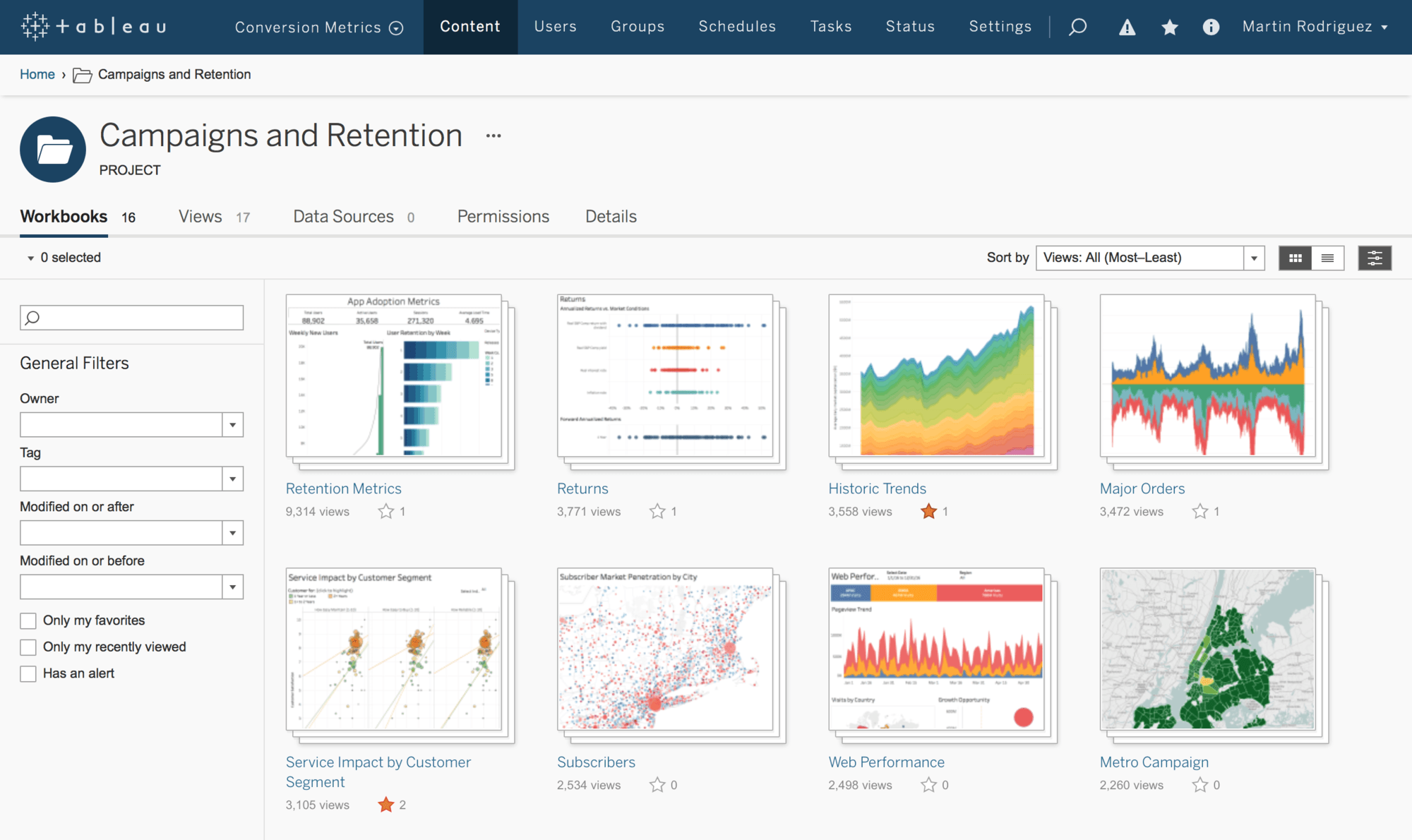

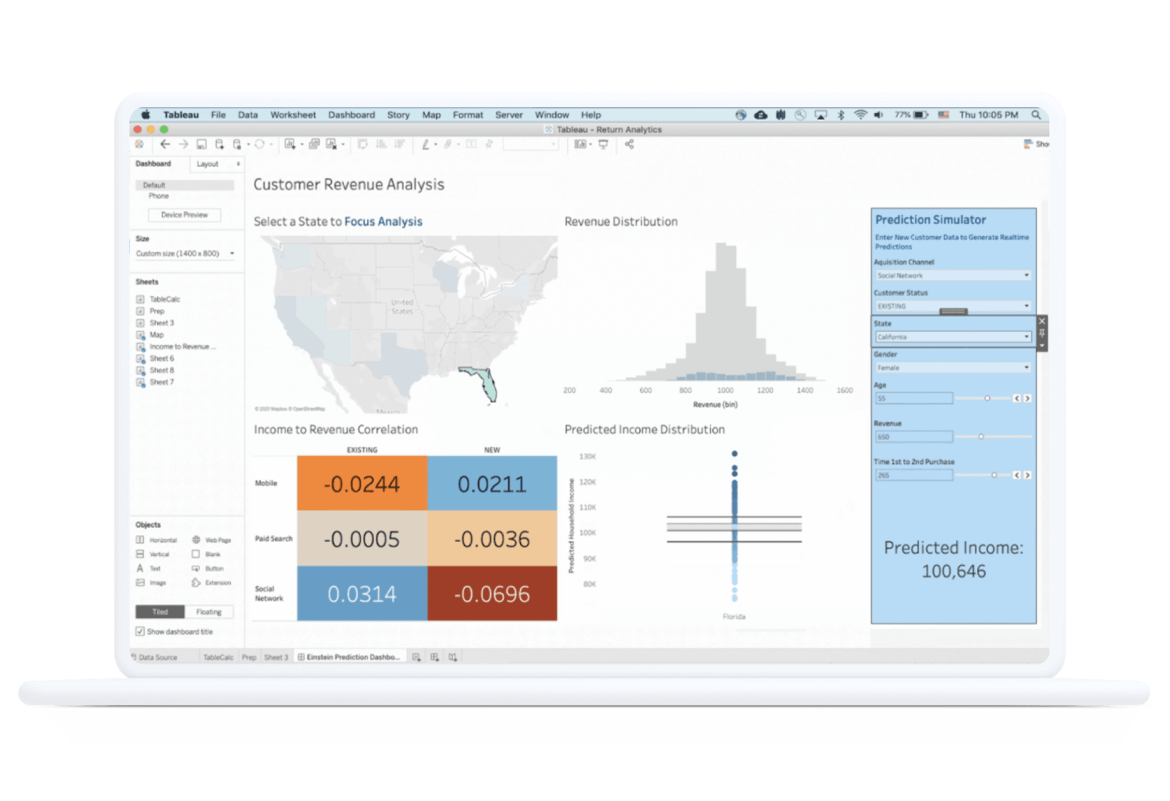

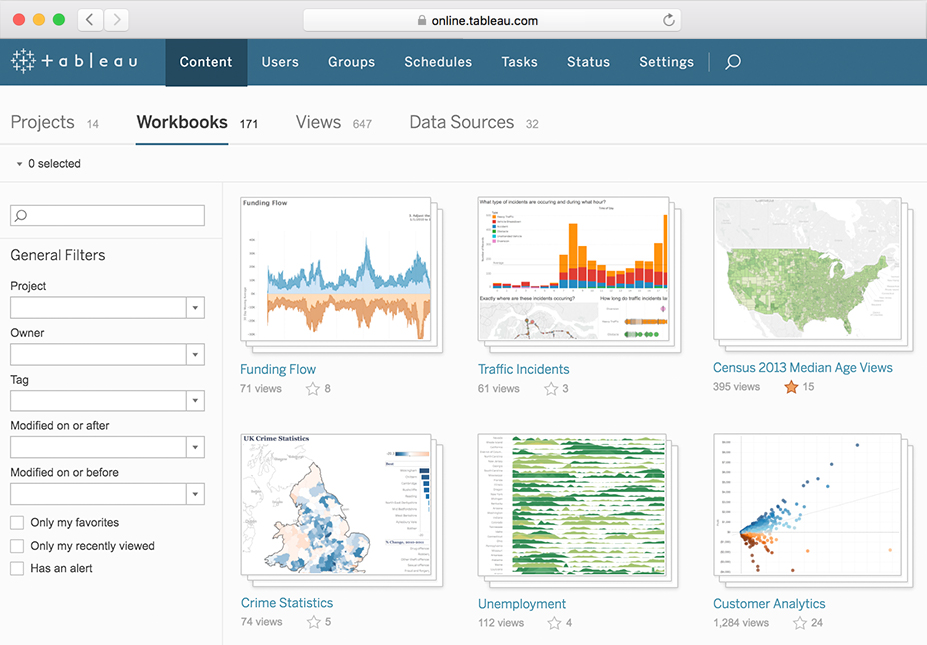

The most well-known products in the area of BI & Analytics of the company Tableau are Tableau Server, Tableau Desktop, Tableau Online, Tableau Public, and Tableau Cloud. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Tableau can be characterized by good support on the following topics:

The most well-known products in the area of BI & Analytics of the company Tableau are Tableau Server, Tableau Desktop, Tableau Online, Tableau Public, and Tableau Cloud. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Tableau can be characterized by good support on the following topics:

- analytics

- data management

- analysis

- embedded analytics

- business intelligence

- dashboards

- advanced analytics

- Python

- predictive analytics

- Salesforce

Figure 55: Tableau Server

Figure 55: Tableau Server Figure 56: Tableau Desktop

Figure 56: Tableau Desktop Figure 57: Tableau Online

Figure 57: Tableau Online20. ThoughtSpot

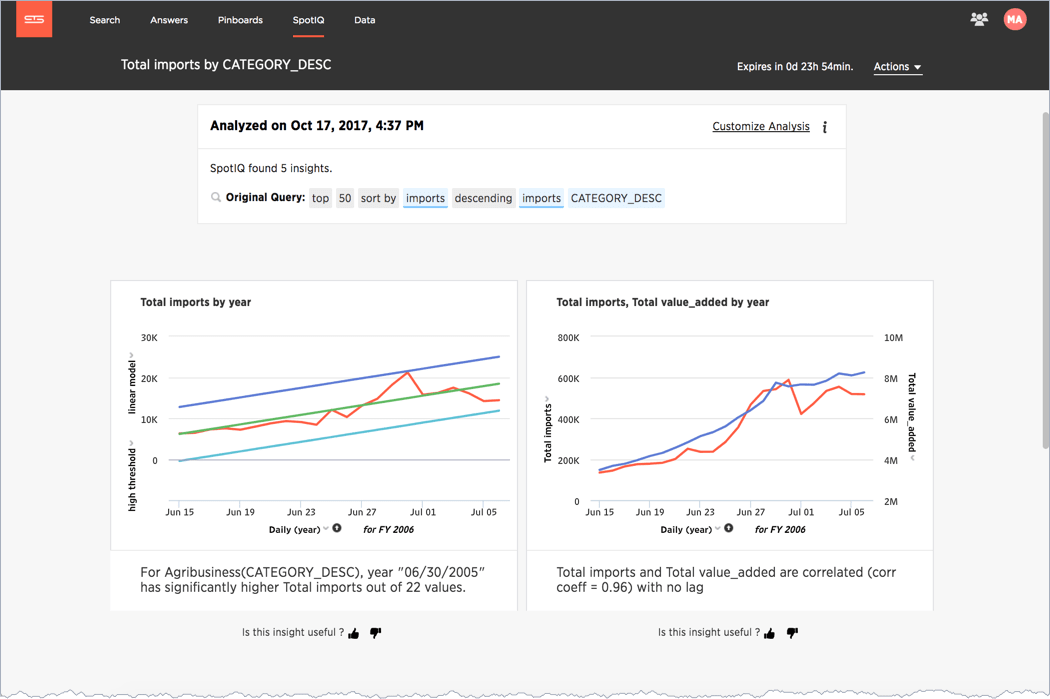

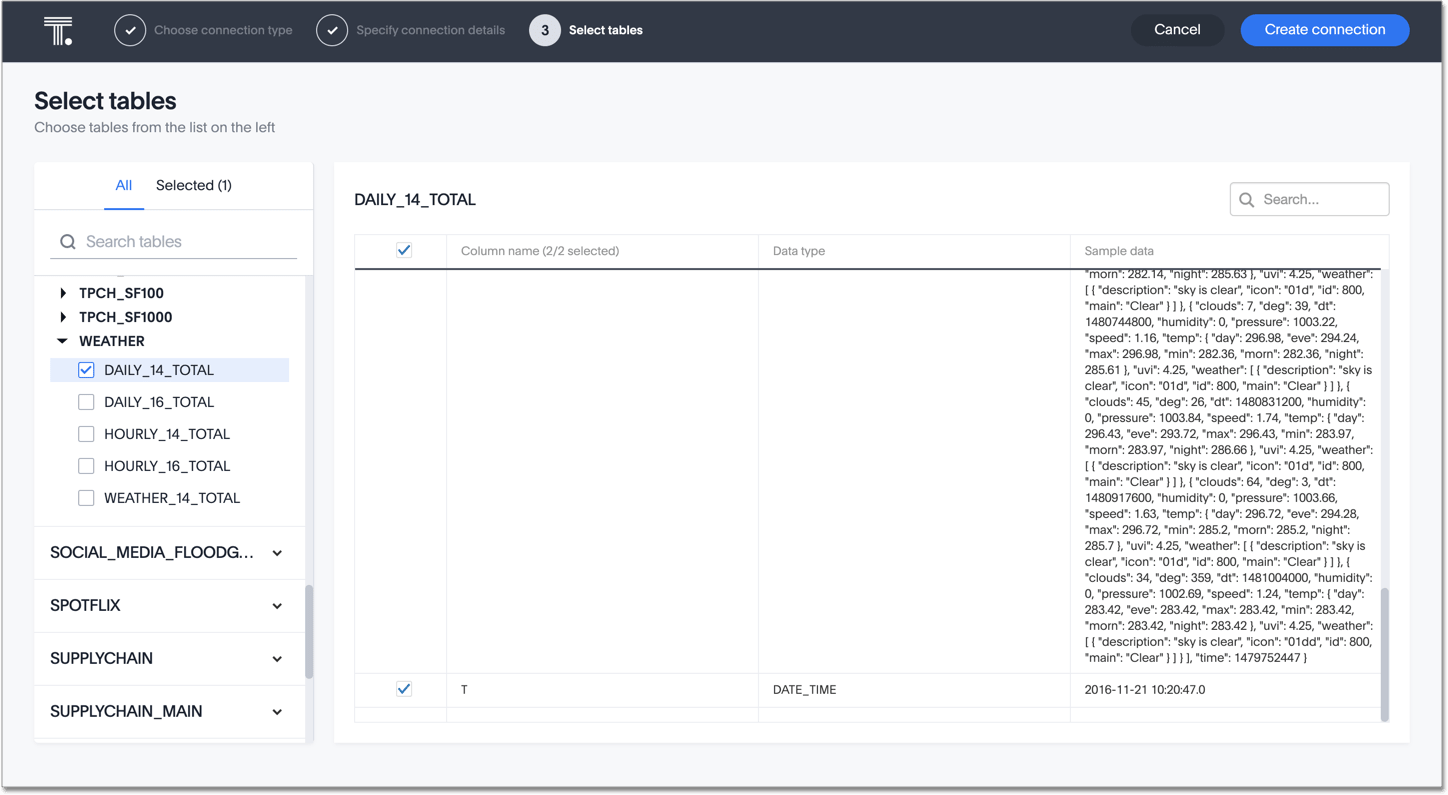

ThoughtSpot is widely known for its products SpotIQ, ThoughtSpot Embrace, ThoughtSpot mobile, ThoughtSpot DataFlow, and ThoughtSpot Business Intelligence. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from ThoughtSpot are strong in the following areas, among others:

ThoughtSpot is widely known for its products SpotIQ, ThoughtSpot Embrace, ThoughtSpot mobile, ThoughtSpot DataFlow, and ThoughtSpot Business Intelligence. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from ThoughtSpot are strong in the following areas, among others:

- analysis

- business intelligence

- analytics platform

- Teradata

- in-memory

- Android

- iOS

- share insights

- natural language

Figure 58: SpotIQ

Figure 58: SpotIQ Figure 59: ThoughtSpot Embrace

Figure 59: ThoughtSpot Embrace Figure 60: ThoughtSpot mobile

Figure 60: ThoughtSpot mobile21. TIBCO

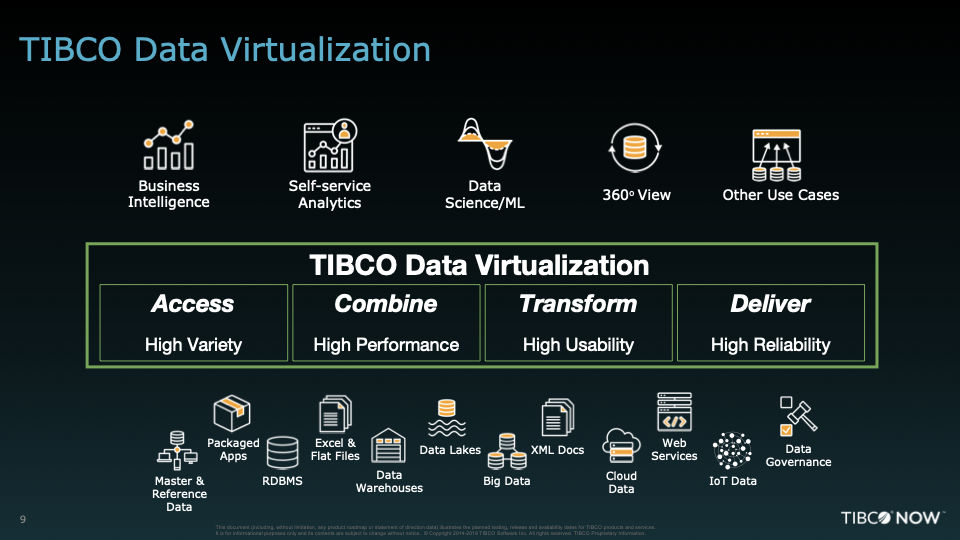

TIBCO is widely known for its products TIBCO Spotfire, TIBCO Data Science, TIBCO Data Virtualization, Jasperreports, and TIBCO Analytics. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from TIBCO are strong in the following areas, among others:

TIBCO is widely known for its products TIBCO Spotfire, TIBCO Data Science, TIBCO Data Virtualization, Jasperreports, and TIBCO Analytics. The company is 100% specialized in BI & Analytics. Take a look at the images below. The Business Intelligence tools from TIBCO are strong in the following areas, among others:

- analytics

- real-time

- data science

- streaming

- MDM

- data quality

- data virtualization

- data catalog

- reporting

- analysis

Figure 61: TIBCO Spotfire

Figure 61: TIBCO Spotfire Figure 62: TIBCO Data Science

Figure 62: TIBCO Data Science Figure 63: TIBCO Data Virtualization

Figure 63: TIBCO Data Virtualization22. Wyn Enterprise

As far as we have been able to ascertain, Wyn Enterprise currently has only one primary product: Wyn Enterprise Business Intelligence. Take a look at the screen shots below. The Business Intelligence tools from Wyn Enterprise are strong in the following areas, among others:

As far as we have been able to ascertain, Wyn Enterprise currently has only one primary product: Wyn Enterprise Business Intelligence. Take a look at the screen shots below. The Business Intelligence tools from Wyn Enterprise are strong in the following areas, among others:

- dashboards

- enterprise business intelligence

- analytics

- reporting

- embedded business intelligence

- interactive dashboards

- analysis

- self-service BI

- business intelligence platform

Figure 64: Wyn Enterprise Business Intelligence

Figure 64: Wyn Enterprise Business Intelligence Figure 65: Wyn Enterprise Business Intelligence

Figure 65: Wyn Enterprise Business Intelligence Figure 66: Wyn Enterprise Business Intelligence

Figure 66: Wyn Enterprise Business Intelligence23. Yellowfin

The most well-known products in the area of BI & Analytics of the company Yellowfin are Yellowfin Signals, Yellowfin Suite, Yellowfin Dashboards, Yellowfin SAML Bridge, and Yellowfin Data Discovery. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Yellowfin can be characterized by good support on the following topics:

The most well-known products in the area of BI & Analytics of the company Yellowfin are Yellowfin Signals, Yellowfin Suite, Yellowfin Dashboards, Yellowfin SAML Bridge, and Yellowfin Data Discovery. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Yellowfin can be characterized by good support on the following topics:

- dashboards

- business intelligence

- analysis

- reporting

- data discovery

- data preparation

- analytics platform

- data science

- data storytelling

Figure 67: Yellowfin Signals

Figure 67: Yellowfin Signals Figure 68: Yellowfin Suite

Figure 68: Yellowfin Suite Figure 69: Yellowfin Dashboards

Figure 69: Yellowfin Dashboards24. Zoho BI & Analytics

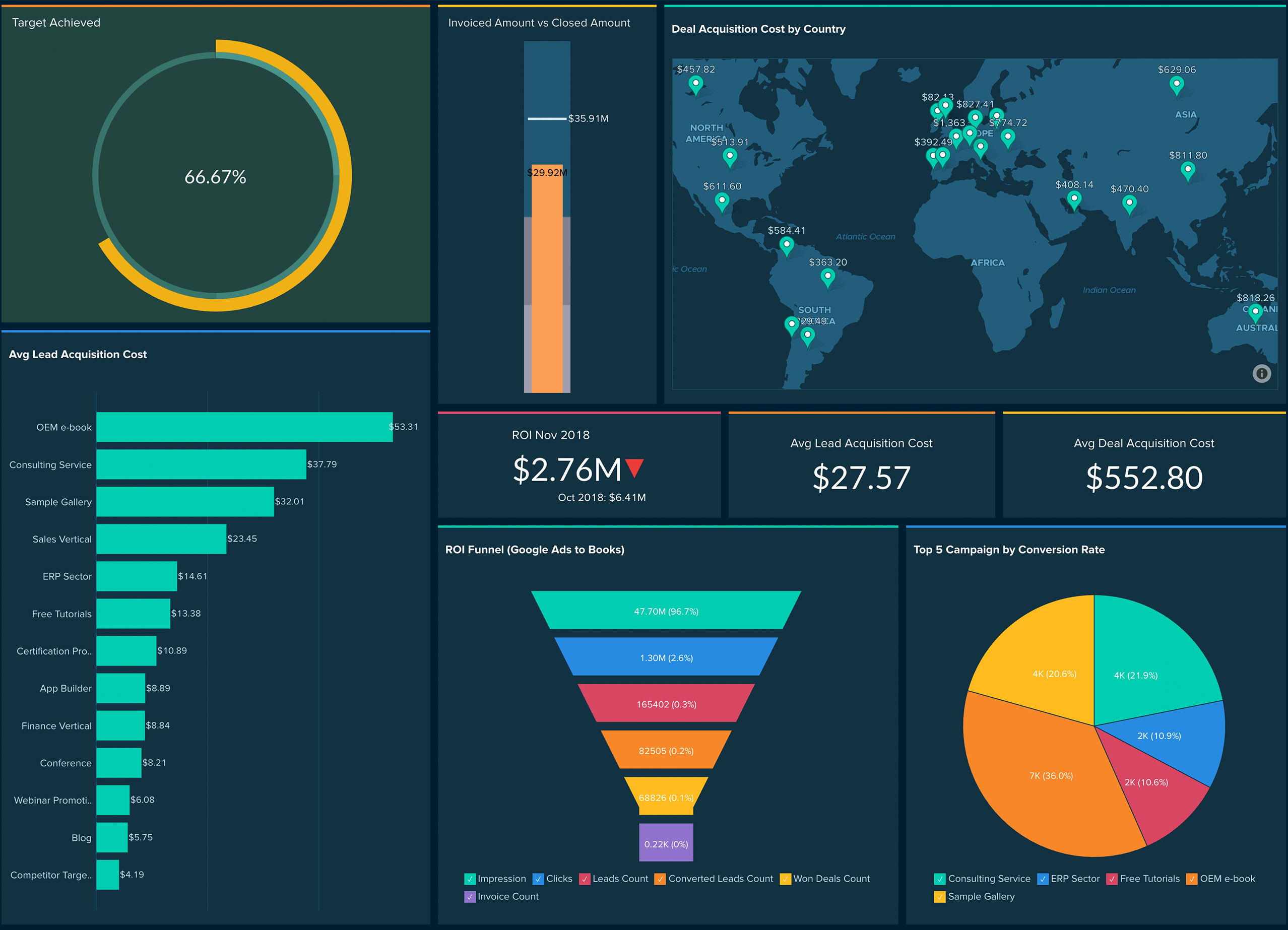

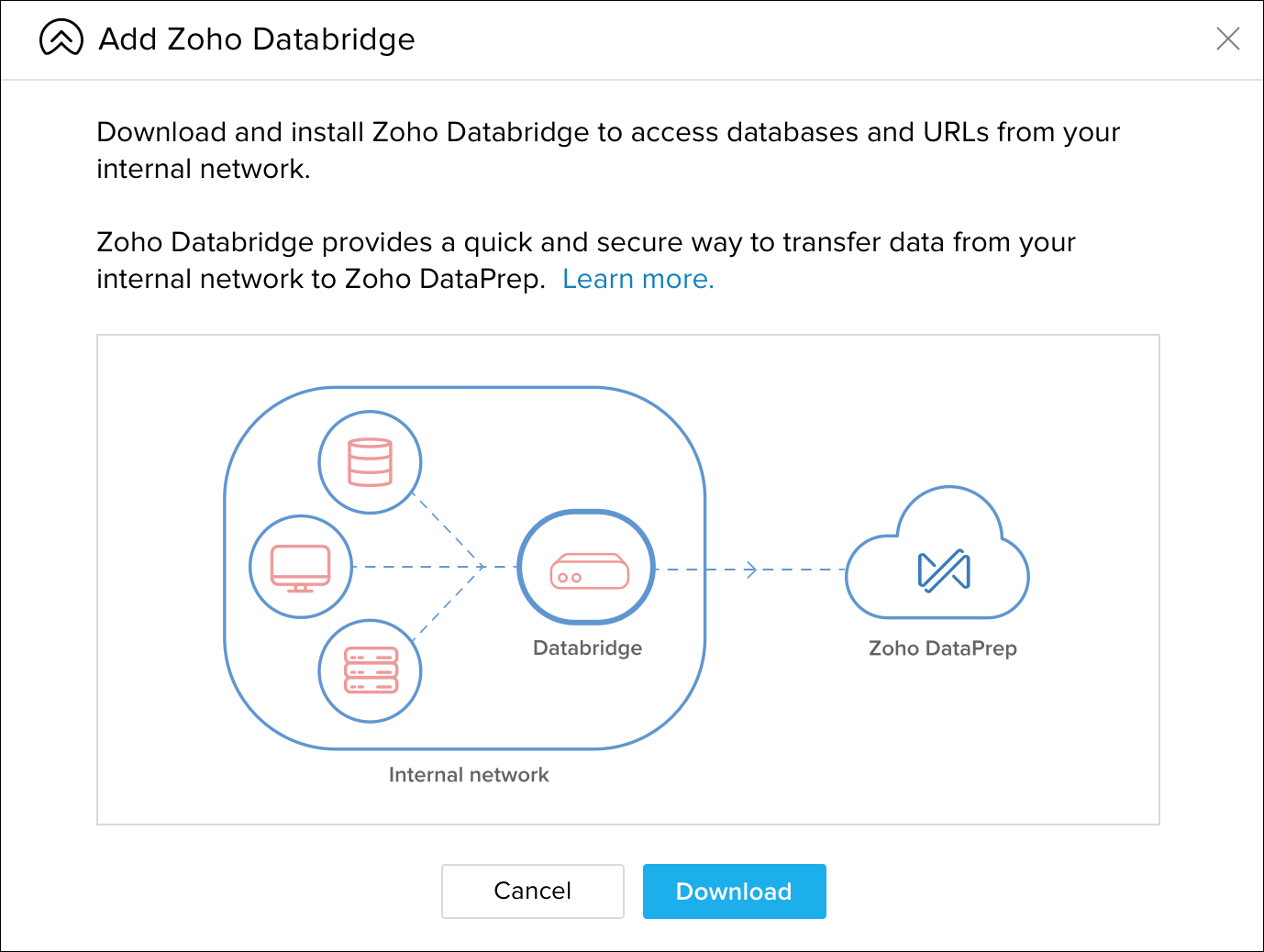

The most well-known products in the area of BI & Analytics of the company Zoho are Zia, Zoho Databridge, Zoho DataPrep, and Zoho Analytics Server. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Zoho can be characterized by good support on the following topics:

The most well-known products in the area of BI & Analytics of the company Zoho are Zia, Zoho Databridge, Zoho DataPrep, and Zoho Analytics Server. We analyzed and evaluated these BI & Analytics products in depth and meticulously. The Business Intelligence tools from Zoho can be characterized by good support on the following topics:

- analytics

- dashboards

- data preparation

- CRM

- Windows

- SQL

- business intelligence

- self-service BI

- mobile business intelligence

- self-service data preparation

Figure 70: Zoho Analytics

Figure 70: Zoho Analytics Figure 71: Zia

Figure 71: Zia Figure 72: Zoho Databridge

Figure 72: Zoho Databridge

How can BI tools help an organization?

Business Intelligence tools equip organizations with reliable management information and advanced insights to enhance decision-making and collaboration. With BI tools, you can generate detailed reports, perform in-depth analyses, and visualize key performance indicators (KPIs) through intuitive dashboards, ensuring data-driven success.

The BI & Analytics Guide™ 2025 If you need help choosing the right BI or data science tool for you, the BI & Analytics Guide can help you to quickly arrive at a shortlist and make a final selection. Our BI & Analytics Guide gives you many comparison functionalities. See which vendor excels in which area and compare vendors in just a few clicks.

If you need help choosing the right BI or data science tool for you, the BI & Analytics Guide can help you to quickly arrive at a shortlist and make a final selection. Our BI & Analytics Guide gives you many comparison functionalities. See which vendor excels in which area and compare vendors in just a few clicks.

Excel: the most misused BI tool

Choosing the wrong BI tool can significantly impact your organization. Many companies struggle with inefficient information infrastructure, preventing them from effectively extracting the management information they need. Excel is a prime example of this issue – it is widely used for Business Intelligence but often falls short, earning its reputation as the most misused BI tool. While Excel is powerful for spreadsheets, it lacks the scalability, automation, and advanced analytics capabilities required for true BI success.

How to choose the best BI tool?

Some people download a popular BI tool without much thought and start using it enthusiastically. That’s great – until they realize later that key functionalities are missing, costs rise with more users, or the tool isn’t as simple as promised. That’s why making an informed choice is essential. Here are the five most important steps to selecting the right Business Intelligence software:

- Define the most important BI tool selection criteria: IT needs and user requirements

- With this list, contact vendors for answers (RFI)

- Analyze all the data from the different Business Intelligence vendors

- Shortlist up to 3 vendors and BI tools that score best

- Start a “proof of concept” and choose the solution that best fits your requirements

Of course, you can use tools like ChatGPT for assistance, but their accuracy and reliability can sometimes be questionable, making it unclear which information to trust. However, you can skip steps 1 through 4 entirely by downloading our independent BI tool comparison guide. We’ve handled the time-consuming research for you, saving valuable time and ensuring that the information is correct.

Let us help you with your BI tool selection

Selecting the right BI software is a time-consuming process – we know this from experience. For over 20 years, we have been guiding organizations through this journey with our expertise, supported by our powerful assessment tool, the Business Intelligence & Analytics Guide, and our independent BI consulting services.

The 250+ functionalities of Business Intelligence software

Business Intelligence tools come in many forms, each with its own strengths. Some excel in reporting, while others are designed for dashboarding. Some are platform-specific, running only on Windows. In our BI vendor survey, we compare all these tools across 250+ criteria that are critical for achieving the best results with business analytics – so you don’t have to conduct this research yourself.

Need help choosing the right Business Intelligence tool?

If you need assistance selecting the best BI tool for your business, feel free to contact us for more information or to schedule an appointment.

About Passionned Group

Passionned Group is the specialist in designing and implementing Business Intelligence tools and Data Science. Our passionate BI consultants help large and small organizations transform into an intelligent organization. Every other year we organize the Dutch BI & Data Science Award©, the election of the smartest organization in the Netherlands.

Passionned Group is the specialist in designing and implementing Business Intelligence tools and Data Science. Our passionate BI consultants help large and small organizations transform into an intelligent organization. Every other year we organize the Dutch BI & Data Science Award©, the election of the smartest organization in the Netherlands.