Sharpen your strategy and boost performance with the Balanced Scorecard

The Balanced Scorecard is a practical model for measuring, improving, and managing your organization’s performance in alignment with its strategy. Using four interconnected perspectives, it translates goals into actionable steps and measures progress consistently. This provides clear insights into what works and what doesn’t, helping you make targeted adjustments. While it has some drawbacks, the benefits outweigh them, especially when paired with KPI dashboards. These dashboards automate performance tracking, offering real-time updates on team and organizational goals. Regular monitoring, analysis, and team discussions create alignment and commitment. The Balanced Scorecard is an essential tool for modern managers aiming to embrace data-driven work and avoid common pitfalls.

What is a Balanced Scorecard?

The Balanced Scorecard was introduced by Kaplan and Norton as a comprehensive model for performance management. As a decision-maker or manager, it helps you manage and improve all key performance areas in an integrated manner. The core of the method lies in understanding which “levers” to adjust and what actions to take. This approach was revolutionary at the time, addressing the overreliance on financial metrics. Financial indicators alone fall short because they measure only one dimension – money – and often reveal problems too late. We define the Balanced Scorecard method as follows:

A Balanced Scorecard is a framework that enables organizations to measure, manage, and enhance performance in a cohesive manner, fully aligned with their strategic objectives.

In simpler terms, it translates strategy into actionable steps across four perspectives and evaluates the resulting performance. This integrated approach exemplifies strong governance and is essential for becoming a leader, as Kaplan and Norton advocate.

The 4 perspectives of the Balanced Scorecard

Since Kaplan and Norton introduced the Balanced Scorecard, it has gained widespread popularity but has also faced criticism. Some call it a “paper exercise,” a ritual with little practical value. However, companies that actively use the model tell a different story. They find it to be an effective tool for managing operational, tactical, and strategic goals in a balanced, results-oriented manner. Modern managers particularly value the four perspectives for creating better alignment between finances, customers, processes, and learning and growth.

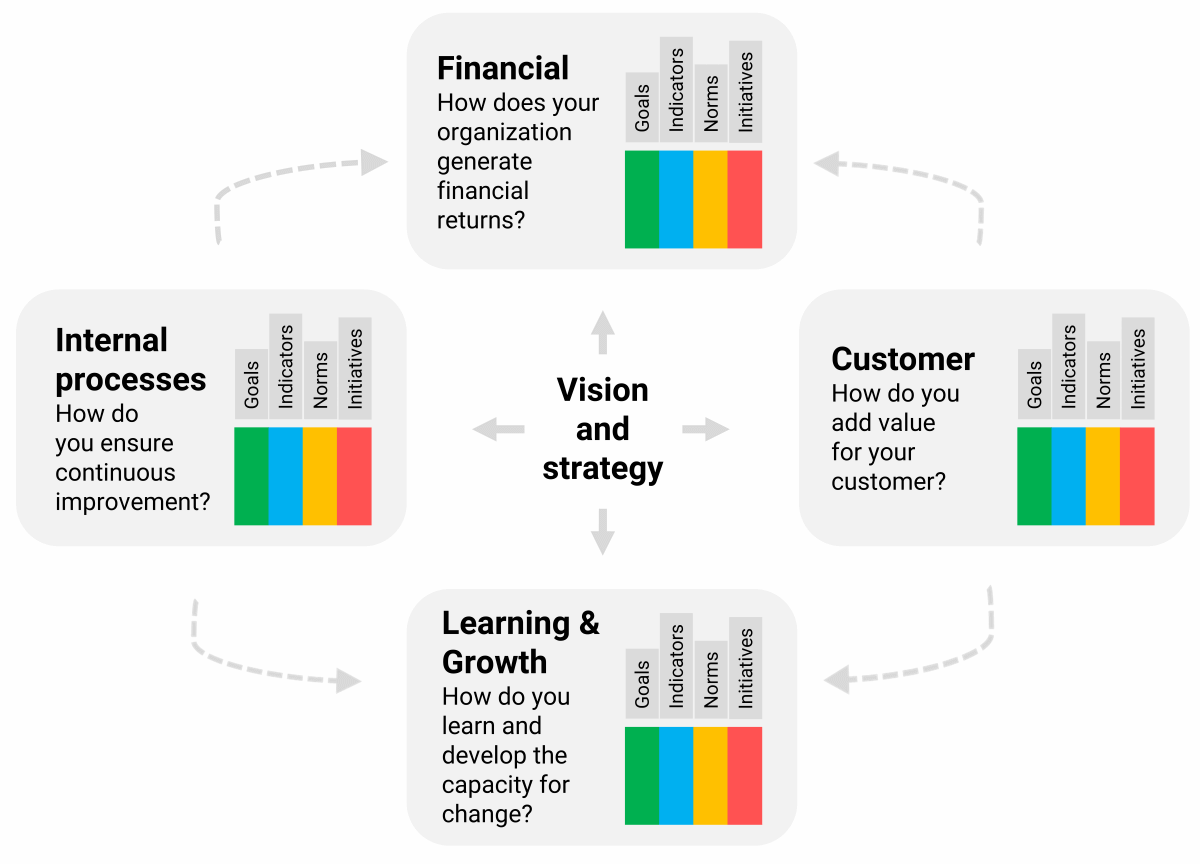

Figure 1: The four perspectives of the Balanced Scorecard let you manage integrally.

Figure 1: The four perspectives of the Balanced Scorecard let you manage integrally.

- Financial perspective: This focuses on achieving a healthy margin. What drives financial success for your organization? Where are the profit-generating areas, and how can you ensure long-term financial sustainability?

- Customer and market perspective: This examines how you create value for your customers. How do they perceive your products or services? Understanding and enhancing the customer experience is key in this perspective.

- Internal process perspective: This is about optimizing and continuously improving your processes. It includes identifying inefficiencies, boosting productivity, and addressing bottlenecks, especially in your core operations.

- Learning & Growth perspective: This focuses on sustaining long-term growth and development. It involves both tangible and intangible factors, such as employee skills, training programs, and building future-ready technology infrastructure.

These four perspectives ensure a balance between short-term results and long-term objectives. A well-designed Balanced Scorecard aligns all metrics with your overarching strategy, creating a unified focus across your organization.

Tip: While the financial perspective is often depicted as the primary focus, you can rotate and adjust the model to suit your goals. For instance, you could prioritize the customer perspective or emphasize learning and growth – it’s all about what drives your strategy.

Tip: While the financial perspective is often depicted as the primary focus, you can rotate and adjust the model to suit your goals. For instance, you could prioritize the customer perspective or emphasize learning and growth – it’s all about what drives your strategy.Being more successful with the Balanced Scorecard

To implement and apply the Balanced Scorecard successfully, it’s essential to understand both its advantages and disadvantages. Many challenges arise from its potential drawbacks, leading to difficulties during implementation. In some cases, these issues discourage organizations from adopting the model altogether. This hesitation can result in failed strategic initiatives and poor execution of strategies. To avoid these pitfalls, it’s crucial to have a clear understanding of the Balanced Scorecard’s strengths and weaknesses before you begin.

Advantages of the Balanced Scorecard

The Balanced Scorecard is a straightforward and easy-to-understand model. The insights from the four key perspectives allow you to illustrate and reinforce the causal relationships between them. For example, you can clearly connect how customer satisfaction, internal processes, financial performance, and learning & growth influence one another. This interconnected approach offers several significant benefits.

In addition to these well-known advantages, the Balanced Scorecard provides other benefits. Organizations using the model tend to experience less hierarchy, reduced power struggles, and fewer political games. Decisions are based on facts and data rather than intuition, and the value proposition for customers often improves significantly.

Disadvantages of the Balanced Scorecard

While the Balanced Scorecard offers compelling advantages, it also has notable challenges, including a relatively high failure rate. Research shows that this rate, while improved from 70% to around 55%, remains significant. This indicates that while the model may seem straightforward and easily transferable, achieving successful implementation is often far more complex. Many of its disadvantages stem from difficulties in meeting the necessary conditions for effective application.

At first glance, these drawbacks seem like killjoys for the responsible application of the Balanced Scorecard, yet they are certainly not insurmountable. They are merely an additional argument for delving thoroughly into the principles before you start designing it at all.

Three key principles

The strength of the Balanced Scorecard lies in its ability to clearly reveal the strategic impact of performance drivers behind financial results. Every financially successful organization benefits from leveraging this model. Effective strategy implementation hinges on three key principles:

The strength of the Balanced Scorecard lies in its ability to clearly reveal the strategic impact of performance drivers behind financial results. Every financially successful organization benefits from leveraging this model. Effective strategy implementation hinges on three key principles:

- describing the strategy with a strategy map

- measuring the strategy with true KPIs

- managing the strategy with dashboards

It’s important to note that true KPIs specifically refer to non-financial performance indicators. While these KPIs may influence financial outcomes, they are not financial metrics themselves. Read more about this in the SMART KPI Guide 2025.

Effective steering & forecasting

The Balanced Scorecard goes beyond financial measures, enabling more effective steering. By aligning connected goals, KPIs, standards, and initiatives, the model achieves optimal alignment – a key factor behind its power. It seamlessly integrates financial metrics with the performance drivers that influence them.

Tip: Invest in Learning & Growth

Research consistently shows that organizations investing significantly in the Learning & Growth perspective outperform others over time. This includes fostering innovation, which contributes to sustained success.

Research consistently shows that organizations investing significantly in the Learning & Growth perspective outperform others over time. This includes fostering innovation, which contributes to sustained success.

Financial growth eventually comes naturally

Organizations focusing on optimizing internal processes and enhancing customer value often see financial growth as a natural outcome.

All intelligent, data-driven organizations and financially successful companies adhere to the principles of this model. Steering solely by financial metrics is less effective, as it forces you to react to past events. Financial ratios are the result of prior processes and activities. The Balanced Scorecard enables earlier measurement and adjustment of processes, giving you greater control and predictive insights. When combined with Artificial Intelligence, it can enhance the predictive value of KPIs and even automate decision-making.

Balanced Scorecard obstacles

In addition to the disadvantages already discussed, several factors may hinder the practical application of the Balanced Scorecard.

- Hyper-competition: Operating in a fast-paced, highly competitive market often requires frequent adjustments to strategy. The Balanced Scorecard may struggle in such environments, as rapid changes necessitate equally quick updates to the model. Brignall critiques the model’s imbalance in addressing stakeholders, noting that beyond customers, employees, and shareholders, broader considerations – such as social context and environmental impact – are often excluded. To overcome this, organizations should consider adding new perspectives to address these dimensions.

- Mister Balanced Scorecard: Baraldi and Monolo emphasize that consistent commitment from both top and middle management is essential for successful implementation. Without this commitment, the model cannot reach its full potential. A common issue is that top management often shifts focus to other priorities soon after the Balanced Scorecard’s launch. In organizations where the model becomes overly complex (see disadvantage 5), the controller may be left solely responsible, earning the informal title “Mr. Balanced Scorecard,” which diminishes shared accountability.

- There are no universal models of success: Management models, including the Balanced Scorecard, often appear highly appealing and intuitive, providing structured frameworks with defined perspectives. However, their standardized nature can sometimes lead to unintended side effects. Users must exercise caution to ensure the model is adapted to their unique strategic context rather than relying solely on standard frameworks.

- Copying or standardizing the Balanced Scorecard: Adopting or copying another organization’s Balanced Scorecard to save time can significantly reduce the model’s effectiveness. While business units may share certain characteristics, each organization’s strategy is unique and must be reflected in its Balanced Scorecard. The Balanced Scorecard should be viewed as a strategic theory emphasizing coherence across the four perspectives, not as a one-size-fits-all tool.

While the obstacles above may complicate the application of the Balanced Scorecard, there are also pitfalls to consider. Pitfalls often arise when aspects of the model are overdone (e.g., creating too many KPIs) or when critical elements, such as data literacy, receive insufficient attention. These challenges highlight the need for thoughtful, customized implementation.

The SMART KPI Guide  The SMART KPI Guide is a clear handbook for anyone looking to achieve success with performance management, KPIs, and Balanced Scorecards. This comprehensive guide supports you in identifying and defining KPIs, loading, standardizing, visualizing, and integrating them into daily operations. A rapidly growing number of organizations (2,500+) rely on the SMART KPI Guide as their digital assistant. This complete guide includes numerous KPI examples from a wide variety of sectors, giving you access to a broad range of solutions.

The SMART KPI Guide is a clear handbook for anyone looking to achieve success with performance management, KPIs, and Balanced Scorecards. This comprehensive guide supports you in identifying and defining KPIs, loading, standardizing, visualizing, and integrating them into daily operations. A rapidly growing number of organizations (2,500+) rely on the SMART KPI Guide as their digital assistant. This complete guide includes numerous KPI examples from a wide variety of sectors, giving you access to a broad range of solutions.

Follow theory, not slavishly but critically

When developing strategy maps and building a Balanced Scorecard, it’s wise to draw on the insights of Kaplan and Norton, but not to follow them rigidly. This applies not only to smaller organizations but to all organizations. Continuously evaluate whether the model’s outcomes align with the unique needs and circumstances of your organization.

Tip: Don’t hesitate to omit or add elements or perspectives when it makes sense for your organization. This prevents the tool from becoming overly dominant and helps you avoid setting objectives that misrepresent your strategy – even if they seem to fit neatly within the model’s original framework.

Tip: Don’t hesitate to omit or add elements or perspectives when it makes sense for your organization. This prevents the tool from becoming overly dominant and helps you avoid setting objectives that misrepresent your strategy – even if they seem to fit neatly within the model’s original framework.The 7 biggest pitfalls of a Balanced Scorecard

If you want to be successful with the Balanced Scorecard, be sure to keep in mind some crucial aspects. These are decisive for successful implementation in your organization. Here are the 7 biggest pitfalls to avoid.

- No performance-driven culture & improvement passion: You want to achieve top performance together with your people. You’re ambitious and customer-focused. But a performance-driven culture requires good preparation, tight discipline, resilience, calm and rhythm, and a real winner’s mentality. Performance management also means continuous improvement: raising the bar a little higher each time and giving your people a good example. Only then will they get moving. If such a performance and improvement culture is lacking, then a Balanced Scorecard and KPIs are of no use to your company. What can you do to get a more performance-driven culture? Start by giving and receiving feedback in your organization or team. Do this regularly and practice it. And start discussing the most important KPIs with each other, not monthly but weekly, for example. Without judging or blaming your people.

- Knowledge about change management is lacking: A Balanced Scorecard process is actually a change process focused on the nerve center of your organization. You’re going to visualize that with strategy maps. And then you collectively find out that the priorities are wrong. You realize that your work is part of a larger whole. You clarify those connections and dependencies. You also discover that the current way of steering and managing is outdated. This requires a different attitude and new behavior from employees and managers. In addition, each person in the organization has their own perception of the course of events. You want to arrive together at a correct business model and a new strategy. Then you definitely need to get people on the same page. So to manage all these changes, you need a lot of practical knowledge of change management. If that is missing, then the initiative fails.

- No urgency: The urgency for a Balanced Scorecard should be clear to everyone. Can you properly name what is wrong with the current way of strategy formation, performance management, and steering? What is something new going to accomplish? The top of the organization must be able to make this clear to everyone. And name its urgency. The sense of urgency is strictly necessary because investing in a Balanced Scorecard can quickly become expensive. Especially when you are ambitious and want to do everything exactly by the book.

- Blind spot for data: To make a Balanced Scorecard project successful, you must have a number of competencies and basic skills, such as data literacy, knowledge of data quality, interactive dashboards, data analysis, and data-driven work. If these skills and insights are missing, then the model misrepresents you, or you only partially leverage its power. Data literacy is the consistent use of information for analysis and action by everyone in the organization. To populate KPIs, you need reliable data. But is the available data accurate, complete, and consistent? As you continue to develop the model, you need assurance of this. Almost all Balanced Scorecards today are cast in a digital format, such as KPI dashboards and reports. To make smart use of these, however, you must know the power and limitations of such tools to avoid mistakes.

- Not unique enough: You can’t copy a strategy from your competitor, even if it seems like a smart move at first glance. It is exactly the same with a Balanced Scorecard. You cannot simply copy it from another company either. The added value of the model lies precisely in being able to hone your own strategy so finely that after a while no other company can copy your business model. Even if they knew all the details of it, they won’t succeed. This is because your organizational strategy will have become so deeply ingrained in your people, processes, and systems that it has become an organizational competency. And that’s what makes your Balanced Scorecard unique. Which makes it a powerful strategic weapon to stay ahead of your competitors.

- No balance in control: The Balanced Scorecard is an excellent tool to balance your control. In addition, it strengthens the synergy of the various activities (source: Foundations of the Balanced Scorecard). Still, we very often see projects where the emphasis is on the financial perspective. Such an implementation is doomed to fail. In fact, you do violence to the Balanced Scorecard. It is crucial to learn to understand and improve the underlying drivers of your financial performance. To avoid this pitfall, it is better to start at the bottom with the critical success factors in the Learning & Growth Perspective. That’s also where you often find your organization’s original passion and core competencies. From there, you then work your way up. Through the internal processes perspective and your customer perspective, you then eventually arrive at financial growth.

- Too many indicators: After the critical success factors from your strategy, you start determining the indicators. This way you make the critical success factors measurable piece by piece and thus the progress on the strategy. But you soon find out that you end up with far too many indicators this way. This is a major pitfall that you can therefore quite easily notice and avoid. The solution is to test all indicators by checking whether they meet the 7 characteristics of meaningful KPIs. Only the real KPIs will you use to monitor, manage, and refine your strategy. All other indicators you assess for relevance just to be sure. They then get a less prominent place in your Balanced Scorecard and on the dashboard. Read our blog “Build only the dashboards you need.”

Three valuable tips

In relation to creating a BSC, three practical tips apply to making the Balanced Scorecard a success:

- Guard against it becoming “a fill-in-the-blank exercise.” When creativity and brainpower are lost, the essence of a strategy development process is compromised.

- Critically assess the normativity of Kaplan and Norton’s statements. Their insights might not always be relevant or applicable to your specific situation.

- Realize that there are no universal models of success.

It is always a matter of customization. You must always keep your own distinctiveness in mind. This is the only way to make your own strategy measurable and successful.

Become a leader with our proven approach to scorecarding

Our integral, proven approach to the Balanced Scorecard is defined by focus, simplicity, and decisiveness. We also address the obstacles and pitfalls mentioned earlier. We work directly from strategic goals, leveraging deep knowledge of your sector, and remain 100% tool-independent.

Our integral, proven approach to the Balanced Scorecard is defined by focus, simplicity, and decisiveness. We also address the obstacles and pitfalls mentioned earlier. We work directly from strategic goals, leveraging deep knowledge of your sector, and remain 100% tool-independent.

- Clarifying your strategy: Where necessary, we help you achieve clarity in your organizational strategy at all levels, eliminating any noise in your business model.

- Creating a strategy map: We make your strategy tangible with a strategy map that includes critical success factors and meaningful KPIs.

- Interpreting scorecards: We guide you through defining goals, measurements, standards, and initiatives for each organizational unit.

- Encouraging participation: Everyone in your organization has room to contribute, ensuring a clear understanding of their role in achieving strategic objectives.

- Automating scorecard management: We streamline scorecard management with dashboards and, optionally, a robust Business Intelligence solution for efficiency.

- Providing coaching and facilitation: We coach and support your employees and managers in the practical application of the Balanced Scorecard. See also our training courses and workshops.

In short, our experts in Balanced Scorecarding and KPIs guide you through the entire process from start to finish, helping you enhance performance at every step.

Strategic change processes: no sinecure

Finally, a note of perspective. In practice, the skill to successfully implement and manage strategy is considered much more important than the intrinsic quality of the strategy. Successfully shaping and leading strategic change processes is no easy task. The Balanced Scorecard is “only” a tool for this.

The danger is that the steps of this method give false security to management, distracting attention from the actual causes behind the unsuccessful achievement of strategic goals. Consider inadequate management direction or dysfunctional social processes in the organization. So don’t absolutize the concept of the Balanced Scorecard. Use it as a framework to arrive at your own strategic management process.

Learn more about Balanced Scorecards here

Want to know where we get our knowledge and experience about Balanced Scorecarding and how you can delve further into the topic? Consult the following resources:

Want to know where we get our knowledge and experience about Balanced Scorecarding and how you can delve further into the topic? Consult the following resources:

Engage the thought leaders

Do you want a powerful Balanced Scorecard instead of a paper tiger? The consultants at Passionned Group are the right choice. With extensive experience in advising and implementing performance management and Balanced Scorecard processes, we are here to help.

As thought leaders, we’ve authored several books on this fascinating subject. Knock on our imaginary door today to schedule an appointment and discuss implementing a crystal-clear, widely supported Balanced Scorecard for your organization.

About Passionned Group

Passionned Group specializes in designing and implementing Balanced Scorecards, performance management, and data-driven working. Our dedicated consultants assist organizations of all sizes in transforming into smart, performance-driven enterprises.

Passionned Group specializes in designing and implementing Balanced Scorecards, performance management, and data-driven working. Our dedicated consultants assist organizations of all sizes in transforming into smart, performance-driven enterprises.

Frequently Asked Questions

What is a Business Balanced Scorecard?

There is basically no difference in definition between a regular Balanced Scorecard and a Business Balanced Scorecard. They are synonyms. The latter will probably be intended primarily for businesses.

Where did the Balanced Scorecard come from?

Robert Kaplan (1940) and David Norton (1941) are the founders of the Balanced Scorecard. They described their pioneering model in detail in their book The Balanced Scorecard: Translating Strategy into Action (1996).

What are the 4 perspectives of the Balanced Scorecard?

The four perspectives of the Balanced Scorecard are: the financial perspective, the customer perspective, the internal processes perspective, and the learning and growth perspective (also called innovation). See the 4 perspectives in detail here.

What are some examples of financial KPIs in the BSC?

Examples of financial indicators include revenue growth, profit margin, return on investment, and cost control. For more KPI examples, download our SMART KPI Guide 2025.

What customer-facing indicators are measured in the BSC?

Customer-centric indicators can include customer satisfaction (NPS score), customer loyalty, repeat purchases, market share, and number of complaints. Also, check out our SMART KPI Guide for more information.

What internal process indicators are relevant within the BSC?

Internal process indicators can include quality, efficiency, waste, scrap, response times, lead times, and productivity. For more process KPIs, download our SMART KPI Guide 2025.

What do you measure in the Learning & Growth Perspective?

You can measure learning and growth through indicators such as employee satisfaction, level of training, degree of knowledge sharing, and technical know-how. Want to see more examples? Then download our SMART KPI Guide 2025.

Can you copy a Balanced Scorecard from another organization?

No, you can’t just copy a strategy from your competitor or colleague, even though at first glance it may seem like a smart move. It is exactly the same with a Balanced Scorecard. You can’t simply copy that from another company either.

Joint strategy development and performance monitoring with

Joint strategy development and performance monitoring with  Using the Balanced Scorecard inherently links long-term strategic planning with short-term action and budget planning. This integration leads to positive impacts on the organization’s overall performance. The model bridges the gap between strategic concepts and their realization, with the four perspectives playing a major role in aligning goals with execution.

Using the Balanced Scorecard inherently links long-term strategic planning with short-term action and budget planning. This integration leads to positive impacts on the organization’s overall performance. The model bridges the gap between strategic concepts and their realization, with the four perspectives playing a major role in aligning goals with execution. The Balanced Scorecard integrates financial and non-financial perspectives, encouraging long-term thinking across the organization. Non-financial measures, in particular, ensure a complete view of the business model and strategy by allowing analysis of critical success factors within each perspective.

The Balanced Scorecard integrates financial and non-financial perspectives, encouraging long-term thinking across the organization. Non-financial measures, in particular, ensure a complete view of the business model and strategy by allowing analysis of critical success factors within each perspective. The Balanced Scorecard promotes a culture of open information exchange. By focusing the organization on interconnected goals, it encourages employees to share information to interpret performance scores effectively. This openness is further reinforced during the collaborative creation of the scorecard and

The Balanced Scorecard promotes a culture of open information exchange. By focusing the organization on interconnected goals, it encourages employees to share information to interpret performance scores effectively. This openness is further reinforced during the collaborative creation of the scorecard and  Visualizing goals and success factors with the Balanced Scorecard makes strategy more accessible and understandable. The model serves as a communication tool that enables leaders to provide a clear overview of organizational strategy to all employees. Using tools like strategy maps, it illustrates how different pieces of the strategy fit together.

Visualizing goals and success factors with the Balanced Scorecard makes strategy more accessible and understandable. The model serves as a communication tool that enables leaders to provide a clear overview of organizational strategy to all employees. Using tools like strategy maps, it illustrates how different pieces of the strategy fit together. The cause-and-effect relationships in a Balanced Scorecard are often challenging to define, leading to overcomplexity as “everything can be related to everything.” While some relationships have a clear direction, many are reciprocal, making it difficult to establish unambiguous connections. Mapping these relationships requires disciplined discussions, a high level of collaboration among managers, and a

The cause-and-effect relationships in a Balanced Scorecard are often challenging to define, leading to overcomplexity as “everything can be related to everything.” While some relationships have a clear direction, many are reciprocal, making it difficult to establish unambiguous connections. Mapping these relationships requires disciplined discussions, a high level of collaboration among managers, and a  Developing a Balanced Scorecard requires significant time, effort, and management capacity – often much more than anticipated. This contradicts the simplicity the model initially promises. Enthusiasm for creating “a simple A4 with KPIs” can quickly turn into frustration, as the process demands diligence and consistency. Successful development also requires knowledgeable and empathetic individuals to lead the project.

Developing a Balanced Scorecard requires significant time, effort, and management capacity – often much more than anticipated. This contradicts the simplicity the model initially promises. Enthusiasm for creating “a simple A4 with KPIs” can quickly turn into frustration, as the process demands diligence and consistency. Successful development also requires knowledgeable and empathetic individuals to lead the project. After completing the Balanced Scorecard and strategy map, organizations often need a comprehensive information system to generate and visualize scorecard data. While financial systems are typically well-established, non-financial perspectives often require data that may not yet exist or is not in the required format.

After completing the Balanced Scorecard and strategy map, organizations often need a comprehensive information system to generate and visualize scorecard data. While financial systems are typically well-established, non-financial perspectives often require data that may not yet exist or is not in the required format. Regarding the use of non-financial indicators, a number of specific difficulties and drawbacks can be identified.

Regarding the use of non-financial indicators, a number of specific difficulties and drawbacks can be identified. The idea behind the Balanced Scorecard is that a small set of indicators provides enough information to monitor the realization of strategy. That is also the charm. The process of selecting these vital few indicators is difficult. And that is precisely why the trivial many indicators easily creep in. Allowing for less relevant performance indicators easily increases the quantity on the scorecard dramatically. This can quickly lead to information overload. The model then becomes so extensive that it no longer provides a quick overview. The original intention “everything on one A4” can then no longer be realized.

The idea behind the Balanced Scorecard is that a small set of indicators provides enough information to monitor the realization of strategy. That is also the charm. The process of selecting these vital few indicators is difficult. And that is precisely why the trivial many indicators easily creep in. Allowing for less relevant performance indicators easily increases the quantity on the scorecard dramatically. This can quickly lead to information overload. The model then becomes so extensive that it no longer provides a quick overview. The original intention “everything on one A4” can then no longer be realized.