Direct and fast access to BI & analytics research, select BI tools quickly

The BI & Analytics Guide™ 2025 gives you instant access to a large amount of directly applicable knowledge about BI, analytics, big data, and artificial intelligence (AI). Whether you want to select a BI tool or vendor, or learn all about the field itself, this guide will save you a lot of time (and money). In our guide 26 BI vendors and more than 150 BI products are covered like Power BI, Qlik Sense, Tableau, OBIEE, TIBCO Spotfire, etc. All the research has been done for you: we have “measured” the vendors and mapped the entire field. We do this from a 100% independent perspective. This unique guide has recently been completely updated. Download the BI & Analytics Guide 2025 now.

Why buy the BI & Analytics Guide?

The interactive Business Intelligence & Analytics Guide is compiled by experts with over 20 years of experience in the field and is designed for the broad community of employees, consultants, and managers who are (or will be) involved in BI, AI & Analytics. The applications of this guide are large but the two most common uses of our BI & Analytics Guide are:

We’ve brought all these applications together in one easy-to-use, cleanly designed interface so you can do your job faster and advise your colleagues or clients more precisely and effectively.

The topics in this unique guide: over 250 selection criteria

The following main topics are included in the online BI & Analytics Guide. Each main topic also contains a large number of sub-topics. In total more than 1,000 criteria can be used for selection, analysis and learning.

✪ How algorithms work

✪ Artificial Intelligence

✪ Audio-, video- & text analytics

✪ Big data analytics

✪ Business Intelligence

✪ Connectivity

✪ Dashboarding & KPI’s

✪ Data discovery

✪ Data governance

✪ Data lakes (data marts)

✪ Data storytelling

✪ Data virtualization

✪ Deep learning

✪ Infrastructure & cloud

✪ In-memory BI

✪ Internet of Things (IoT)

✪ Machine learning

✪ Mobile BI

✪ Multidimensional models

✪ Neural networks

✪ Performance optimization

✪ Performance management

✪ Real-time capabilities

✪ Root cause analysis

✪ Self-service functionality

✪ Statistical analysis

✪ Star and snowflake schemes

These are just a few of the great learning potentials of our BI & Analytics Guide: you won’t run out of things to learn. You will also experience how the market works, which suppliers have a strong and steady focus on BI & Analytics, and what their strengths and weaknesses are. Get the most out of the BI & Analytics Guide and download it now.

The vendors and their product portfolio

The BI & Analytics Guide 2025 contains (at this time) material from all major BI tool vendors with all their relevant products. For example, Microsoft alone has more than thirty BI products and some other vendors don’t disappoint.

Figure 4: Radar charts flawlessly expose the strengths and weaknesses of various vendors.

Figure 4: Radar charts flawlessly expose the strengths and weaknesses of various vendors.

Hover your mouse over a vendor and you will see all the BI products of that particular vendor. You will get to know them all. Is a vendor not listed? On request, we will add a relevant vendor for you without any charge.

Alteryx Designer - Alteryx Server - Alteryx Analytics - Alteryx Connect - Alteryx Intelligence Suite - Alteryx Promote - Alteryx APA Platform - Alteryx AiDIN

✪

DataRobot Artificial Intelligence - DataRobot MLOps - DataRobot Core - DataRobot platform - DataRobot AutoML

✪

Domo Platform - Domo Data Science - Domo Business Intelligence - Domo Data Visualization - Domo Mobile - Domo Business Automation - Domo Business Optimization

✪

Dundas BI - Dundas Data Visualization - Dundas Dashboard - Dundas BI Data Flow

✪

✪

Pentaho Data Integration - Pentaho Business Analytics - Hitachi Content Platform - Pentaho Data Mining - Pentaho Report Designer - Pentaho Big Data - Hitachi Video Analytics - Pentaho Kettle - Hitachi Data Center Analytics - Lumada Edge Intelligence - Pentaho Analytics - Pentaho BI Server - Pentaho CDE - Lumada Data Services - Pentaho Dashboard Designer - Pentaho Data Science Pack - PDI Community Edition - Pentaho Business Analytics Server - Pentaho Sever - Pentaho Design Studio - Lumada Data Optimizer

✪

Cognos Analytics - IBM SPSS - IBM Watson - IBM Infosphere - Netezza - IBM Cloud Pak - IBM Planning Analytics - IBM SPSS Modeler - IBM SPSS Statistics - IBM Cognos TM1 - IBM Business Analytics - IBM Infosphere Information Server - Netezza Performance Server - IBM Cognos Real - time - IBM Cognos Real - time Monitoring - IBM BigInsights - IBM Cognos Analysis - DB2 OLAP Server - Cognos Cube Designer - IBM Cognos Analysis Studio - IBM Banking Data Warehouse - IBM Infosphere Information Analyzer - IBM SPSS Predictive Analytics - IBM SPSS Text Analytics - Watson Natural Language Processing - IBM Video Analytics - IBM Cognos TM1 Server - IBM SPSS Modeler Server - IBM data fabric

✪

Incorta Analytics - Incorta analyzer

✪

InetSoft Style Intelligence - InetSoft Business Intelligence - InetSoft Data Intelligence - InetSoft Style Studio - InetSoft Data Cleansing

✪

Infor Birst - Infor BI - Infor Coleman - Infor Landmark - Infor Coleman AI - Infor Data Lake - Infor Landmark Reporting - Infor BI Dashboards - Birst Analytics - Infor Business Vault - Infor IoT - Infor Lawson Analytics - Birst Sales Analytics - Infor Corporate Performance Management - Infor Business Analytics

Logi Info - Logi Composer - Logi Report Server - Logi Predict - Logi Report Designer - Logi Analytics Platform

✪

Looker Studio - LookML - Looker API - LookML Dashboards - Looker Blocks - Looker Server - Looker mobile - Looker Data Analytics - Looker Embedded Analytics - Looker Retail - Looker Data Modeling - Looker Marketing Analytics - Looker Web Analytics - Looker Digital Marketing

✪

Power BI - Microsoft Azure - Microsoft SQL Server - Azure Synapse Analytics - Azure Stream Analytics - Power BI Desktop - Azure Databricks - Azure Machine Learning - Azure Data Lake - SSAS - SSIS - Azure Cognitive Services - Azure Data Factory - Power BI Report Server - Power BI Premium - Azure Data Studio - SQL Server Management Studio - SQL Server Reporting Services - Microsoft AI - Azure IoT Hub - Azure Machine Learning Studio - Microsoft Power Query - Power BI Report Builder - Microsoft Business Intelligence - SQL Server Machine Learning - Microsoft Machine Learning - Microsoft R Server - Microsoft Fabric - Azure Storage Explorer - Microsoft Advanced Threat Analytics - Microsoft Machine Learning Server - Azure Data Warehouse - Microsoft AI Platform - SQL Server Data Mining - Microsoft Data Platform - Microsoft Flow Analytics - Databricks Delta Lake - Azure Advanced Analytics - Microsoft Power BI Pro - Microsoft Power Platform - Microsoft Power BI Enterprise - Microsoft Power Platform admin

✪

Oracle Analytics - Oracle Database - OBIEE - Oracle Big Data - Oracle Analytics Server - Oracle Data Integrator - Oracle Essbase - Oracle Fusion Middleware - Oracle Hyperion - Oracle Big Data Appliance - Siebel Analytics - Oracle Exadata - Oracle Stream Analytics - Oracle Data Mining - Oracle Business Intelligence Applications - Oracle Business Intelligence Publisher - Oracle NoSQL Database - Oracle OLAP - Oracle Exalytics - Oracle Big Data Connectors - Oracle Analytics Desktop - Oracle Data Miner - Oracle Warehouse Builder - Oracle Enterprise Data Quality - Oracle R Enterprise - Oracle Fusion Analytics - Oracle Endeca - Oracle TimesTen - Oracle Big Data Discovery - Essbase Studio - Oracle Data Integration - Oracle Smart View - Oracle Flexcube Universal Banking - Oracle Retail Analytics - Oracle Big Data Lite - Oracle Financial Consolidation - Oracle Data Science - Oracle Financial Management Analytics - Oracle Insurance Insight - Oracle Fusion Customer Relationship Management - Oracle Data Hub - Oracle Data Profiling - Oracle Data Warehouse - Oracle Data Management - Ohi Data Marts - Oracle BDA - Oracle DRM - Oracle Supply Chain Analytics - Oracle AI Platform - Oracle Health Insurance Analytics - Oracle Data Visualisation - Oracle Endeca Studio - Oracle Data Quality Management - Obi Analytics - Oracle Data Modeling - Oracle Bis Discoverer - Siebel TimesTen

✪

Pyramid Analytics - Pyramid Decision Intelligence Platform - Pyramid Data Science Workbench - Pyramid Smart Insights

✪

Qlik Sense - QlikView - Qlik Sense Enterprise - Qlik Replicate - Qlik NPrinting - Qlik Geoanalytics - Qlik Compose - QlikView Server - Qlik Sense Desktop - Qlik Data Integration - Qlik Analytics - Qlik Data Catalyst - Qlik Sense Server - QlikView Desktop - Qlik Associative Engine - Qlik Analytics Platform - Qlik Enterprise Manager - Qlik Data Integration Platform - Qlik AutoML - QlikView Expressor - Qlik Sense Engine - Qlik Datamarket - Qlik Geoanalytics Connector - Qlik Sense Apps - Qlik Big Data - Qlik Geoanalytics Server - Qlik Reporting Service - Qlik Data Warehouse - Talend Data Fabric - Qlik SAP Analytics

✪

✪

SAP HANA - SAP Analytics Cloud - SAP BusinessObjects - SAP Analytics - SAP BW - SAP Lumira - SAP Businessobjects BI - SAP Cloud Platform - Sybase - SAP Conversational AI - SAP Data Warehouse - SAP Predictive Analytics - SAP Data Services - Xcelsius - SAP Data Hub - SAP Crystal Reports - SQL Anywhere - SAP IQ - Fiori Launchpad - SAP HANA Streaming Analytics - SAP NetWeaver Business Intelligence - SAP BusinessObjects Analysis - SAP BusinessObjects Dashboards - SAP Analytics Hub - SAP Businessobjects BI Platform - S/4HANA Embedded Analytics - SAP BusinessObjects Web Intelligence - SAP Businessobjects Design Studio - SAP Crystal Server - SAP Leonardo Machine Learning - SAP Web Analytics - SAP BusinessObjects Predictive Analytics - Lumira Cloud - SAP Lumira Designer - SAP Agile Data Preparation - SAP Leonardo IoT - SAP NetWeaver Business Warehouse - SAP Big Data - SAP HANA Data Warehousing - SAP Mobile BI - SAP Lumira Server - SAP BI Platform - Rapid Marts - SAP Insurance Analyzer - SAP Data Quality Management - SAP BusinessObjects Data Services - Native Spark Modeling - SAP Businessobjects Financial Consolidation - SAP Sybase Replication Server - SAP HANA Enterprise - SAP BEx - SAP BI Mobile Server - SAP Sybase Adaptive Server - SAP Master Data Management - SAP Machine Learning - SAP BusinessObjects Enterprise BI - SAP Analytics Designer - SAP BusinessObjects Analysis Office - SAP Data Management - SAP HANA Advanced Analytics - SAP Businessobjects Dashboard Design - SAP Data Science - SAP Enterprise Analytics - SAP Enterprise Data Management - SAP BussinessObjects Edge - SAP HANA Text Analytics - Bpmon Analytics

✪

SAS Viya - SAS Visual Analytics - Dataflux - SAS/ACCESS - SAS Enterprise Guide - SAS Enterprise Miner - SAS Data Integration - SAS Event Stream Processing - SAS Data Integration Studio - SAS Customer Intelligence - SAS Visual Data Mining - SAS Cloud Analytic Services - SAS Data Management - SAS Cloud Analytic - SAS Data Quality - SAS Forecast Server - SAS Visual Text Analytics - SAS BI Dashboard - Dataflux Data Management Studio - SAS Visual Statistics - SAS Customer Intelligence 360 - SAS Mobile BI - SAS Web Report Studio - Dataflux Data Management Server - SAS Field Quality Analytics - SAS Federation Server - SAS Intelligent Decisioning - SAS Enterprise BI - SAS Grid Manager - SAS Visual Forecasting - SAS OLAP Server - SAS Text Miner - SAS Business Rules Manager - SAS Data Loader - SAS LASR Analytic Server - SAS Web Analytics - SAS Visual Investigator - SAS Forecast Studio - SAS Enterprise BI Server - SAS OLAP Cube Studio - SAS Real - time Decision Manager - SAS Forecast Analyst Workbench - SAS Forecasting - SAS Visual Analytics App - SAS Marketing Automation - SAS Energy Forecasting - SAS Data Preparation - SAS OLAP Cubes - SAS Data Surveyor - Information Map Studio - SAS Information Delivery Portal - SAS Web Server - SAS Visual Analytics Designer - SAS Asset Performance Analytics - SAS Fraud Framework - SAS Risk Modeling - SAS Deep Learning - SAS Office Analytics - SAS High - Performance Forecasting - SAS Business Analytics - SAS Data Quality Server - Dataflux Authentication Server - SAS Data Explorer - SAS Analytics Platform - SAS Data Science - SAS Customer Analytics - SAS ETL Studio - SAS Text Analytics - SAS Data Governance - SAS Visual Data Discovery - SAS Sentiment Analysis Studio - SAS Advanced Analytics - SAS Visual Analytics Hub - SAS Production Quality Analytics - SAS Big Data - SAS Banking Analytics - SAS Master Data Management - SAS Business Intelligence Platform - SAS Data Integration Server - SAS Machine Learning - SAS Data Warehouse - SAS Predictive Analytics - SAS Artificial Intelligence - SAS Viya Visual Analytics - SAS Omnichannel Analytics - SAS Natural Language Processing - SAS Federal Data Management - SAS Data Surveyor SAP - SAS Visual Data Governance

✪

Elasticube - Elasticube Manager - Sisense Analytics - Sisense ElastiCube - Sisense Blox - Sisense BI - Sisense Pulse - Sisense Dashboards - Sisense REST API - Sisense Platform - Sisense AI - Sisense Mobile BI - Sisense Embedded Analytics - Sisense Forecast - Sisense Elastic Data Hub - Sisense Self - Service - Sisense Usage Analytics - Sisense Self - Service Analytics - Sisense Healthcare Analytics - Sisense Big Data - Sisense Predictive Analytics - Sisense Data Mining - Sisense Retail Analytics - Sisense Periscope - Sisense Data Engineering

MicroStrategy Web - MicroStrategy Intelligence Server - MicroStrategy Analytics - Hyperintelligence - MicroStrategy Desktop - MicroStrategy Office - MicroStrategy ONE - MicroStrategy Cloud Platform - MicroStrategy Hadoop Gateway - MicroStrategy Report Services - MicroStrategy Dossier - MicroStrategy Rest APIs - MicroStrategy Prime - MicroStrategy R Integration Pack - MicroStrategy Embedded Analytics - MicroStrategy Data Mining - MicroStrategy Web Report - MicroStrategy Web Report Editor - MicroStrategy Big Data - MicroStrategy Mobile Analytics - MicroStrategy In - Memory Analytics - MicroStrategy Data Integration - MicroStrategy Mobile Server

✪

Tableau Server - Tableau Desktop - Tableau Online - Tableau Public - Tableau Cloud - Tableau Prep Builder - Hyper API - Tableau Prep Conductor - Tableau Bridge - Tableau Data Management - Tableau Reader - Tableau Mobile - Tableau Hyper - Tableau Server Management Add - on - Tableau Server REST API - Tableau Embedded Analytics - Tableau Pulse - Tableau Data Management Add - on - Ask Data - Tableau Advanced Analytics - Tableau In - memory Data Engine - Tableau Business Intelligence - Tableau GPT - Tableau Predictive Analytics

✪

SpotIQ - ThoughtSpot Embrace - ThoughtSpot mobile - ThoughtSpot DataFlow - ThoughtSpot Business Intelligence

✪

TIBCO Spotfire - TIBCO Data Science - TIBCO Data Virtualization - Jasperreports - TIBCO Analytics - TIBCO Businessworks - TIBCO Streaming - TIBCO Jaspersoft - TIBCO Streambase - TIBCO Spotfire Server - TIBCO MDM - TIBCO Jasperreports Server - TIBCO Messaging - TIBCO Live Datamart - TIBCO Mashery - TIBCO Enterprise Message Service - TIBCO Business Studio - TIBCO Businessworks Container Edition - TIBCO Loglogic - TIBCO Hawk - TIBCO Administrator - TIBCO Spotfire Analyst - TIBCO Data Quality - TIBCO Geoanalytics - TIBCO Openspirit - TIBCO Cloud Mashery - TIBCO MFT - TIBCO Cloud Spotfire - TIBCO Liveview - TIBCO Datasynapse Gridserver - TIBCO Gridserver - TIBCO Spotfire Desktop - Spotfire Data Catalog - TIBCO Spotfire Clinical Graphics - TIBCO Spotfire Lead Discovery - TIBCO Spotfire Network Analytics - TIBCO Spotfire Miner - TIBCO Spotfire Operations Analytics - TIBCO Data Discovery - TIBCO Data Management - IoT Drilling Accelerator - Businessevents Data Modeling - TIBCO Data Integration - TIBCO Datagrid Cache

✪

✪

Yellowfin Signals - Yellowfin Suite - Yellowfin Dashboards - Yellowfin SAML Bridge - Yellowfin Data Discovery - Yellowfin Mobile BI - Yellowfin Data Transformation - Yellowfin Data Preparation - Yellowfin Business Analytics - Yellowfin Data Science - Yellowfin Web Server - Yellowfin Data Analysis

✪

Zoho Analytics - Zia - Zoho Databridge - Zoho DataPrep - Zoho Analytics Server - Zoho Analytics Mobile BI app

Radar charts allow you to compare a BI vendor with all other vendors at a glance, giving you a balanced view of a vendor’s functionality and their strengths and weaknesses.

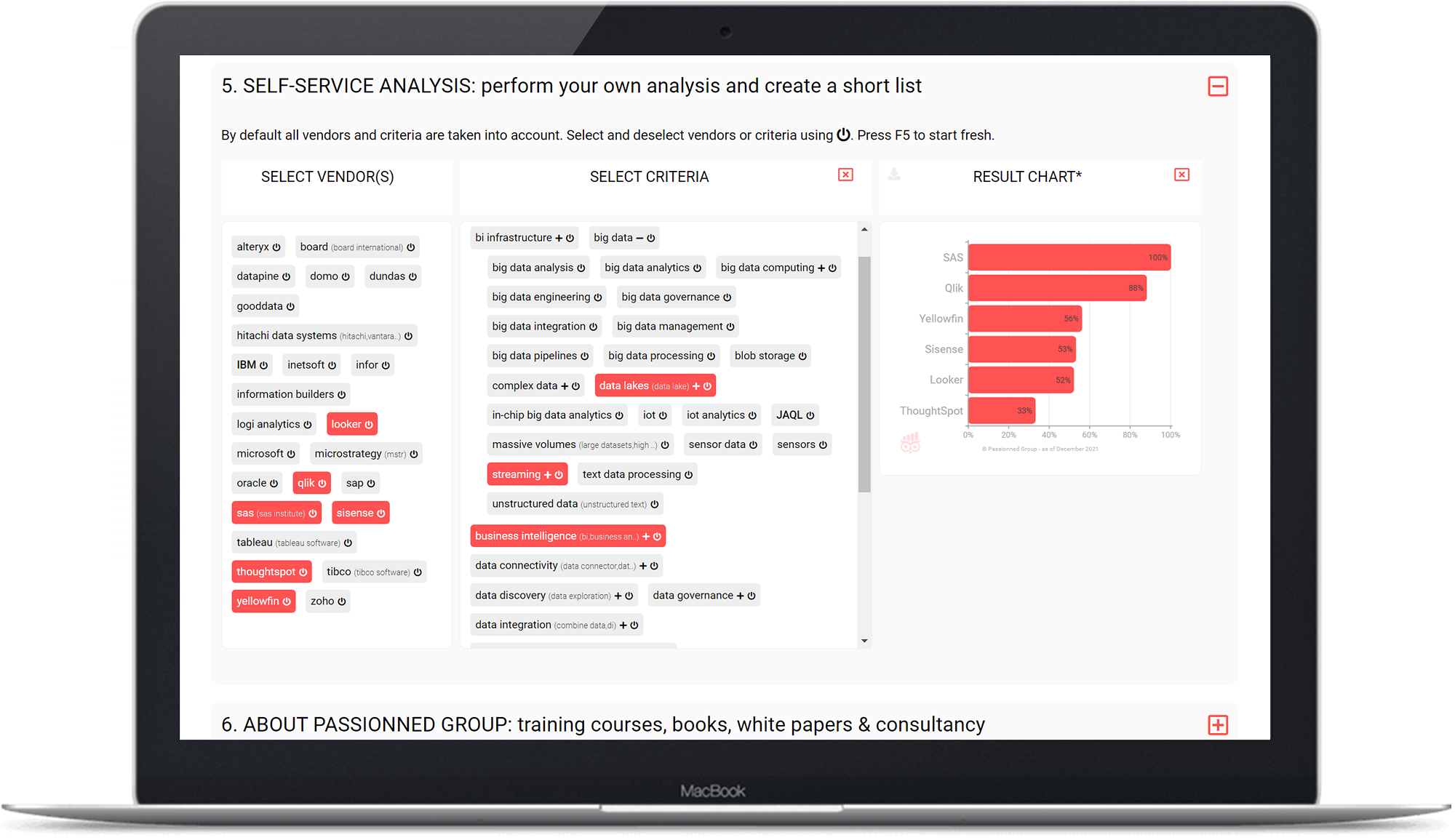

Figure 5: With the self-service module, you determine which suppliers and criteria are in scope.

In addition, the BI & Analytics Guide also contains line graphs that visualize the performance of vendors over time. This gives you direct insight into how quickly or slowly a vendor is innovating. The BI & Analytics Guide can be accessed on any device and is divided into four practical chapters (modules). With each purchase, you get access to three different devices. If you want to use this guide with more users, you can contact us to adjust this.

The 5 main benefits of this guide

- it contains updates renewed quarterly that provide you with the latest trends

- it is 100% objective, we have no preferences or commercial ties

- it contains a clear structure and is richly illustrated with charts

- you will save research time with all the information concisely in one place

- you will strengthen your negotiation power

Download the BI & Analytics Guide 2025 now

The BI & Analytics Guide is the first and only digital guide that is based on objectified data and completely free of bias. Try it out: for € 345 you will be sitting front row from now on, download this unique guide here.

About the author Daan van Beek MSc

Daan van Beek, CEO of Passionned Group, has compiled this comprehensive BI guide based on more than 20 years of experience as a BI consultant, lecturer, and manager. He has been following and researching the BI market since 2007, gauging vendors and comparing their tools objectively. He conveys his groundbreaking ideas on BI, Big Data, and Data Science during (guest) lectures, among other things. He also regularly gives master classes in BI & AI in Malaysia, Singapore, Paramaribo, New York, and South Africa. At the renowned business schools TIAS and EUR, he teaches the subjects of Artificial Intelligence & Data Science.

Daan van Beek, CEO of Passionned Group, has compiled this comprehensive BI guide based on more than 20 years of experience as a BI consultant, lecturer, and manager. He has been following and researching the BI market since 2007, gauging vendors and comparing their tools objectively. He conveys his groundbreaking ideas on BI, Big Data, and Data Science during (guest) lectures, among other things. He also regularly gives master classes in BI & AI in Malaysia, Singapore, Paramaribo, New York, and South Africa. At the renowned business schools TIAS and EUR, he teaches the subjects of Artificial Intelligence & Data Science.

Reviews about Business Intelligence & Analytics Guide™ 2025

Richard Silverstein | Sweet & Maxwell Group: The Passionned Group's Business Intelligence & Analytics survey was immediately useful in selecting the right BI tool for our company.Tom Cole | Director BI and Data Visualization | Nike: The BI & Analytics Guide is a journey, meaning tons of detailed information. In my work, I was able to compare ratings for multiple solutions across the same attribute against over 350 attributes. Also included are links to other material on the internet that allow you to go deeper than your favorite search engine results will find. All in a simple web interface. The research capabilies of this guide are many and matched what I needed. The value I got from using the guide is that it brought me to a conclusion I was not expecting.

Figure 1: Initially you see the ranking of the various suppliers in 15 main categories but you can easily drill down and zoom in on detailed aspects.

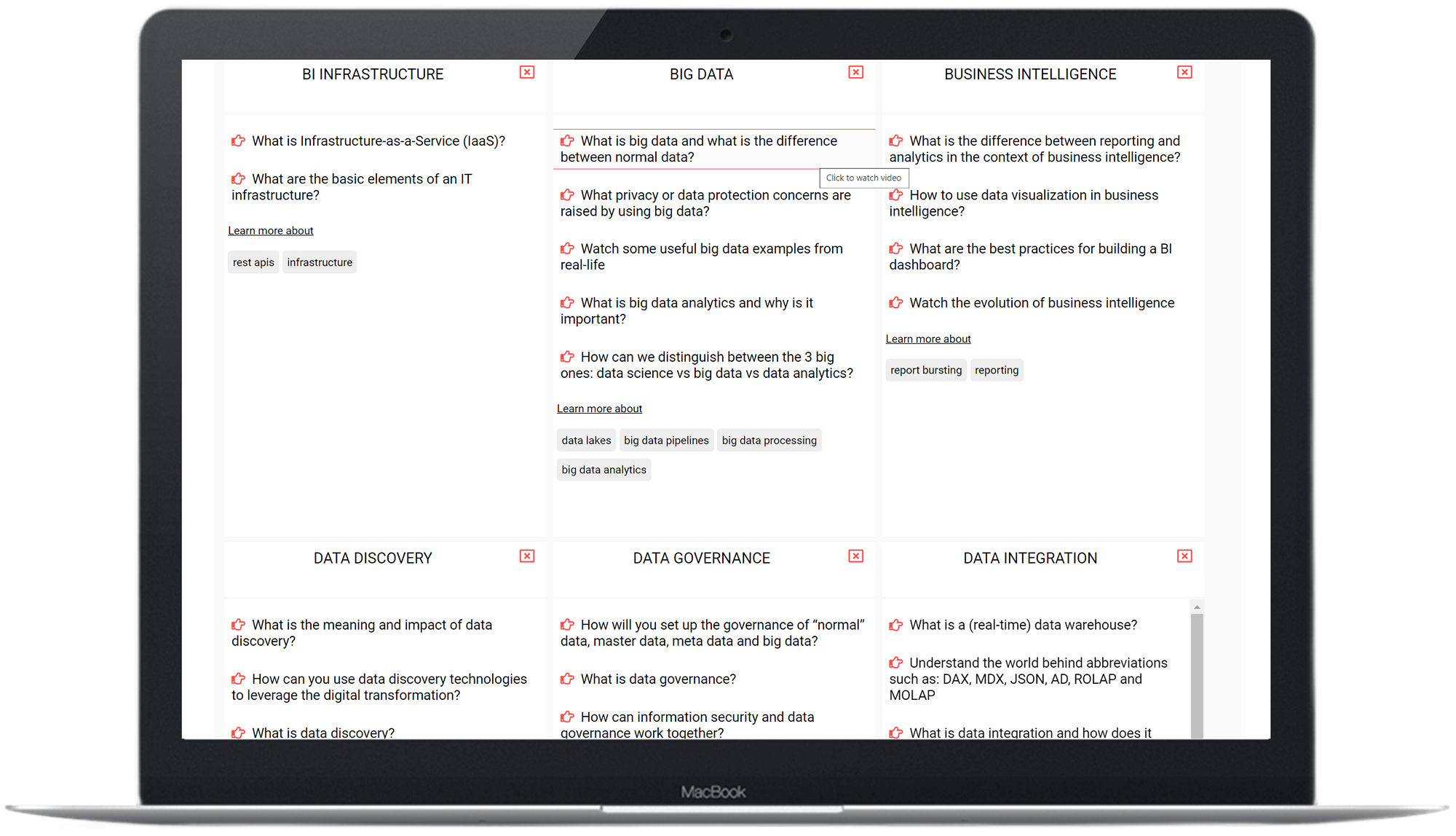

Figure 1: Initially you see the ranking of the various suppliers in 15 main categories but you can easily drill down and zoom in on detailed aspects. Figure 2: The training module contains more than 500 videos and helps you deepen and broaden your knowledge of the field.

Figure 2: The training module contains more than 500 videos and helps you deepen and broaden your knowledge of the field. Figure 3: Multiple videos on Big Data illustrate in an educational way what the possibilities are and what to look out for to achieve success with Big Data analytics.

Figure 3: Multiple videos on Big Data illustrate in an educational way what the possibilities are and what to look out for to achieve success with Big Data analytics.